- THE ECB BLOG

Crossing two hurdles in one leap: how an EU savings product could boost returns and capital markets

27 June 2025

There is now an urgent need to channel retail savings into European capital markets in order to develop those markets and finance EU priorities. In this edition of the ECB Blog, we show that an EU savings standard could increase retail participation in the capital markets, benefiting savers, boosting investment in EU companies and supporting strategic priorities.[1]

There are over 50,000 retail investment funds in the EU, offering a vast array of opportunities and diversified investment options. Investment opportunities are abundant – the key, however, is finding the right products. Increased retail participation in capital markets has the potential to deliver higher returns to savers and cater to diverse risk appetites over long-term horizons. Channelling savings into capital markets would also help to finance the priorities of the EU.

One way to achieve this is by introducing a European savings standard – a standardised, EU-wide set of savings products with potential tax incentives for eligible products.[2] This blog explores the trade-offs faced by policymakers when it comes to designing such a standard and shows how certain selection criteria, for example related to investment costs, would affect the available landscape of investment products.[3]

The trade-off between investment costs and investment objectives

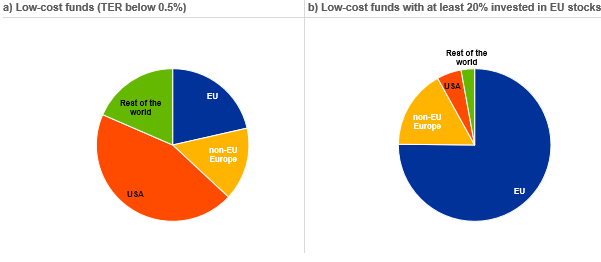

A fundamental feature to factor into the design of a European savings initiative would be a low cost of investing – this would capture the most cost-effective products. However, looking at the investment products that are already available to savers in the EU, it’s plain to see that most of the assets held by low-cost funds, as measured by the total expense ratio (TER), have a global or US focus (Chart 1a). On the one hand, this highlights a crucial trade-off between low-cost products, higher returns and diversification for savers. On the other, it showcases an opportunity to align with European financing priorities. From the consumer’s perspective, ensuring that investments have a broad geographical scope can enhance returns and diversify risk. However, this approach may conflict with the goal of financing European priorities, especially when tax incentives are used to encourage investment in the EU.

Chart 1

Geographical allocation of equity and mixed funds sold to EU retail investors

Source: Lipper for Investment Management data.

Notes: The charts show the fraction of investments by geographical region for the respective sample of investment funds. Panel a) considers all equity and mixed funds with a total expense ratio (TER) below 0.5%, regulated under the Undertakings for Collective Investment in Transferable Securities (UCITS) Directive and available to retail investors in at least one EU member state. Panel b) further restricts the sample of investment funds to those with at least 20% investments in equity of EU companies.

Combining selection criteria enables pursuit of EU objectives

Balancing these objectives requires a policy design that ensures savers benefit from competitive returns and supports the EU’s strategic economic goals. Adding more eligibility criteria for the investment products to be included in the standard would address this trade-off. Starting from the universe of low-cost products, the scope could be narrowed down to investment funds that invest a certain fraction of their portfolios in EU companies. The share should be low enough to ensure sufficient diversification. Even a low threshold, e.g. a minimum 20% of assets invested in the EU, would already allow funds with a European focus to be captured. Chart 1, panel b) shows that funds with annual expenses below 0.5% and a minimum share of 20% invested in EU stocks channel on average 75% of their investments into the EU.[4]

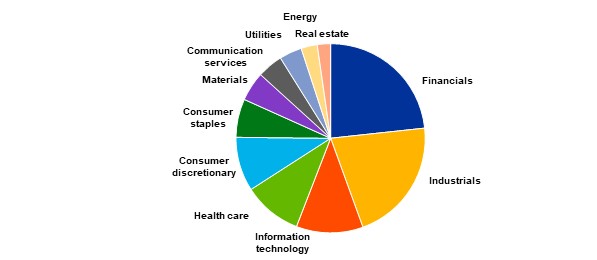

Chart 2 also shows that the selected funds invest in a diverse set of sectors. This benefits the real economy. For example, 11% of the investments are allocated to information technology – a key sector for boosting both innovation and total factor productivity.[5] This example demonstrates how policymakers can adjust selection criteria to reflect policy priorities, while also keeping a diversity of options available to cater for savers’ preferences and ability to take risks.

Chart 2

Industry allocation of low-cost equity and mixed funds with at least 20% invested in EU stocks

Source: Lipper for Investment Management data.

Notes: The chart shows the fraction of investments by industry using the Global Industry Classification Standard (GICS). It considers all equity and mixed funds with a total expense ratio (TER) below 0.5% and at least 20% invested in equity of EU companies, regulated under the Undertakings for Collective Investment in Transferable Securities (UCITS) Directive and available to retail investors in at least one EU member state.

Increased capital markets participation can benefit savers

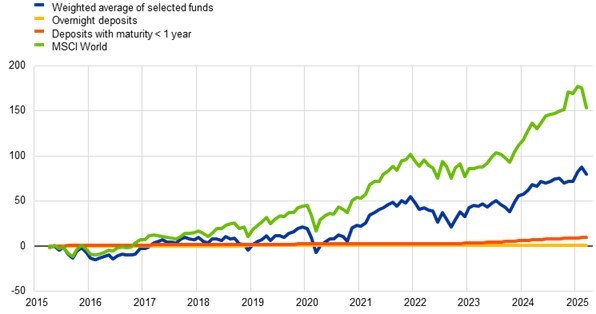

As well as enjoying low investment costs, retail investors should obtain attractive returns. The funds in our sample achieved an average annualised return of 6% over the past ten years (Chart 3), similar to the return on European stock indices such as the MSCI Europe. This is substantially higher than the interest rate on deposits, even those with a fixed term, where most savings are currently held. The foregone return is particularly significant when looking at global indexes.

By investing in capital markets over long periods, savers would benefit from significantly higher returns than they get by holding deposits. And by using tax incentives to shift even a small portion of savings into the selected funds in our sample, policymakers could attract more capital into the EU. Therefore, an EU savings standard would accomplish two things at once.

Chart 3

Average performance of selected funds over the past ten years, compared with deposits

Y-axis: Cumulative return in %

Sources: Lipper for Investment Management data, ECB Data Portal.

Notes: Cumulative return during the period 1 April 2015 to 31 March 2025 net of the total expense ratio, assuming a reinvestment of capital gains and dividends. The selected funds have a total expense ratio below 0.5% and invest at least 20% in EU stocks. To compute the weighted average of returns of these funds, their monthly returns are weighted by fund size at the start of each month.

Investing in capital markets is not without risks, of course. The individual returns of the selected funds vary significantly. They also depend on the timing of the investment. Holding the fund shares over longer periods, e.g. 5 years as a minimum, and incrementally investing small amounts over time would reduce this risk. And it would allow savers to achieve sizeable returns. This confirms that long-term investment horizons are needed to mitigate market volatility and maximise potential gains.

Better financial literacy and an effective communication strategy will be crucial factors for the success of a European savings standard. In turn, the experience of investing in capital markets improves financial literacy. This would also help develop an investment culture among EU citizens.

Savings initiative could boost EU capital market integration

Coordinated tax incentives at EU level could make an EU savings standard more attractive. They would also offer savers tangible financial benefits linked to European objectives and ensure a level playing field. This should go hand in hand with simplifying and streamlining the differences in national taxation procedures stemming from investing across borders. Importantly, to support Single Market integration, the initiative should seek to foster investments across Europe rather than in individual Member States.

Additionally, removing the internal barriers that prevent savers from accessing funds across the EU is essential: the products in our sample are only sold in six countries on average, and none of them are sold in all 27 EU countries. One way to attract potential investors would be to increase transparency around fees and bundling practices. Removing obstacles to market consolidation could also support larger funds in the EU, which could charge lower fees and make the product more competitive and appealing to savers.[6]

Conclusion

A European savings standard could benefit both savers and companies by channelling a share of existing liquidity to the more productive part of the economy while also providing savers with competitive returns. But its design matters. Calibrating the selection criteria, coupled with tax incentives and dismantling barriers to a more integrated EU capital market will be key to achieving the dual goals of maximising returns and supporting EU objectives. Crucially, investors should continue to enjoy flexibility when choosing which products to invest in, as they will ultimately be the ones who shoulder the risk of investing in the capital markets.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

See Lagarde, C. (2024), “Follow the money: channelling savings into investment and innovation in Europe”, speech at the 34th European Banking Congress: “Out of the Comfort Zone: Europe and the New World Order”, Frankfurt am Main, 22 November.

A European savings and investment account would represent a new account where an investor would deposit money that they can invest in funds complying with certain criteria (e.g. investment mandate, deposit limit or withdrawal restrictions) and offering tax incentives. A European savings and investment label, on the other hand, would be applied to existing investment vehicles which comply with certain criteria and could offer tax benefits for the investor. A European savings and investment product would represent a type of investment vehicle, complying with certain criteria and offering tax benefits, and which would actively attract and invest contributions from savers. Our proposal is not committed to one particular form; the focus here is on the impact the proposal could have.

For a discussion on the design features and trade-offs involved, see Arampatzi, A-S., Christie, R., Evrard, J., Parisi, L., Rouveyrol, C. and van Overbeek, F. (2025), “Capital markets union: a deep dive – Five measures to foster a single market for capital”, Occasional Paper Series, No 369, ECB.

This illustrates the current allocation of funds’ investments and does not project the future allocation, or the dynamic effects created by the introduction of selection criteria or tax incentives.

Andreeva, D., Botelho, V., Ferrante, A., Górnicka, L. and Lenoci, F. (2024), “Low firm productivity: the role of finance and the implications for financial stability”, Special Feature in the Financial Stability Review, ECB, November.

See Section 2.5 of the ESCB reply to the European Commission’s targeted consultation on integration of EU capital markets: https://www.ecb.europa.eu/press/consultationresponse/pdf/ecb.conresp202506.en.pdf