4 August 2025

Digital payments are increasing and people are using banknotes and coins less frequently. Is cash on the way out? Piero Cipollone explains why cash is still indispensable and how the ECB is working to ensure it remains readily available and easy to use.

The role of cash has been hotly debated in recent years, especially as the pandemic-driven surge in digital payments has reduced its share in day-to-day transactions, triggering concerns about its future.[1] However, cash is also used as a store of value and demand for it has stayed strong across age groups.[2] Moreover, Europeans want to retain the option to pay with cash[3], so they expect it to remain available in the future.

Against this background, the ECB and the European Commission have been working on strategies to protect euro cash and make it fit for the future. In June 2023, the Commission published the Single Currency Package, which includes two key legislative proposals: one to protect the legal tender status of euro banknotes and coins (the Legal Tender of Cash Regulation) and another for the digital euro (the Digital Euro Regulation).[4] The ECB’s Governing Council welcomed these legislative proposals and their objective to establish a coherent legal framework. The digital euro, banknotes and coins will complement each other, enhancing the range of payment options available by offering cash in both physical and digital forms.[5]

Cash circulation continues growing alongside the digitalisation of payments

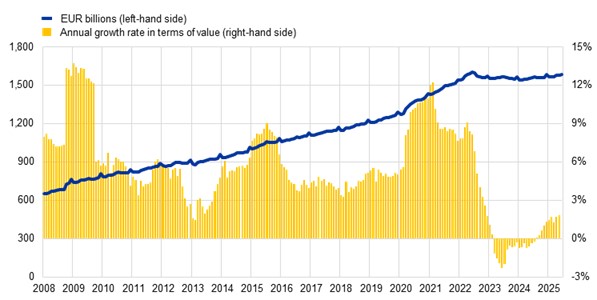

Euro banknotes and coins will continue to play a crucial role as a reliable means of payment and a store of value both within the euro area and abroad – just look at the evolution of euro banknotes in circulation (Chart 1).[6] At present, 30.4 billion banknotes are in circulation, with a total value of €1.6 trillion.[7] After plateauing when we raised interest rates – which made it less attractive for people to hold large of amounts of savings in cash – these figures are growing again, currently at an annual rate of 2.3% in terms of volume and 1.7% in terms of value. To put it into perspective: almost €5,000 worth of banknotes are currently in circulation for each euro area citizen.

The demand for cash during crises, such as the 2008 financial crisis, the European sovereign debt crisis and the COVID-19 pandemic, underscores its importance, especially in turbulent times. Chart 1 highlights the robust demand for banknotes, with spikes during these crises when the annual growth rate of banknotes in circulation more than doubled. The ECB and the national central banks (NCBs) maintain ample stocks of banknotes and effective distribution channels to ensure they are ready to meet these sudden surges in demand.[8]

Chart 1

The steady rise of euro banknotes in circulation

Source: ECB.

Note: The latest observations are for June 2025.

Europeans expect their banks to ensure access to cash services

Good access to cash is fundamental to ensure it functions well. The proposed Legal Tender of Cash Regulation highlights the need for infrastructure to be well distributed geographically to ensure banknotes and coins are available across the entire euro area.[9] However, the decline in bank branches due to banking sector consolidation, along with the shrinking number of ATMs, poses significant challenges.[10]

In a two-tier system, central banks do not directly provide cash services to the public or non-financial companies. Instead, it is up to banks and their service providers to maintain the necessary facilities for offering adequate cash services to private and business customers. Analyses conducted by the Eurosystem central banks have revealed significant differences in the availability of banks’ cash services across countries and regions within the euro area. Naturally, rural and urban areas often have different infrastructure needs, which, in turn, influence the demand for ATMs and bank branches. Surveys further highlight that dissatisfaction with banks’ cash services is growing among both individuals and businesses.[11]

In addition to banks, retailers in some euro area countries also offer limited cash withdrawal services, known as cashback or cash advances, to recirculate surplus cash. From the consumer’s perspective, these services are convenient but cannot replace the essential cash services provided by banks. First, cashback only allows small amounts (usually up to €100 or €200) to be withdrawn, and does not enable people to deposit cash into their bank accounts. Second, and equally important, retailers are not obligated to offer cashback services, and even when they do, this is still contingent on the availability of surplus cash from previous transactions.

As we stated in our opinion on the Legal Tender of Cash Regulation[12], formulating binding rules for banks’ cash service levels requires careful consideration. The ECB has long held that a one-size-fits-all approach may not be suitable for all euro area countries and regions, and that national particularities need to be considered. Nonetheless, it is essential to ensure a sufficient level of access to cash services across the euro area. In particular, the local provision of cash services by banks and comprehensive ATM networks remain indispensable – not least because these are critical for enabling individuals and retailers to withdraw banknotes and coins from, and deposit cash into, bank accounts, thereby sustaining the circulation of cash within the community.

Recognising this, the proposed Legal Tender of Cash Regulation mandates that the European Commission, in consultation with the ECB, establishes common indicators through implementing acts. These common indicators will enable Member States to monitor access to cash services and allow the Commission and the ECB to assess the situation across countries. The ECB, in collaboration with the NCBs, is preparing the required analysis, including a euro area-wide methodology to assess the density of cash access points for citizens, and is working with the Commission to define these common indicators. This analysis considers varying ATM densities relative to population density, and distinguishes, for instance, between urban areas, where shorter distances are applied (1, 2 and 5 kilometres), and rural areas (5, 10 and 15 kilometres).

Moreover, judging by the ongoing discussions within the Council Working Party on the Legal Tender of Cash Regulation, the final text may allow Member States to use complementary national indicators.[13] This combination of common euro area-wide and national indicators would help ensure that people have sufficient and effective access to cash, while also enabling the designated national competent authorities to take targeted corrective measures if shortcomings are identified.

Striking the right balance between fulfilling consumers’ needs and enabling banks to enhance their efficiency is essential when defining the criteria for giving people and firms access to cash services. Bank customers need to be able to both withdraw their funds in cash and deposit cash into their bank accounts. Providing such cash services is a fundamental responsibility of commercial banks and various Member States have enacted laws to that end. The ECB supports national legislation aimed at safeguarding access to cash and works closely with NCBs to monitor cash withdrawal points, such as ATMs and bank branches.

Clearer rules for mandatory acceptance of cash

Euro banknotes and coins have legal tender status across the euro area. Cash is therefore the default means of payment and must be accepted unless both parties mutually and freely agree on another form of payment. This effectively means that payees must accept payment in cash if the payer so insists.

Practices such as merchants refusing cash or displaying “no cash” signs are not only undesirable, as they restrict the payer’s freedom of payment choice, but are also fundamentally inconsistent with the legal tender status of euro cash, as interpreted by the Court of Justice of the European Union (CJEU).[14] One of the reasons why the ECB strongly opposes such practices, which unfortunately seem to be becoming more widespread, is that they risk excluding some members of society, especially those that rely on cash. The ECB stressed this critical stance in its opinion on a proposal for a regulation on the legal tender of euro banknotes and coins, in which it advocated for a clear prohibition of such “no cash” practices.[15] To address this issue, the designated national competent authorities must monitor and enforce compliance once the Legal Tender of Cash Regulation comes into effect. Furthermore, as with any European Union regulation, Member States must establish effective and deterrent sanctioning regimes.

The ECB also advocates for cash acceptance in the public sector, particularly for transport and other public services. In its judgment of 26 January 2021[16], the CJEU clarified that public sector entities may regulate procedures for settling debts through national legislation. Under certain defined conditions that serve the public interest in a proportionate manner, such legislation may permit public authorities to refuse cash payments for the goods or services they provide. Nonetheless, as public authorities are often the sole providers of essential services, they should apply such limitations sparingly and only when absolutely necessary. For instance, public transport providers should make inclusivity a priority and preserve effective cash payment options.

The role of cash in times of crisis

As a resilient and reliable means of payment, cash is indispensable, especially during crises. It remains functional even when electronic payment systems are disrupted by power outages, internet failures, software malfunction or other events. Recent natural disasters and geopolitical tensions have underscored the urgency of ensuring cash continues to circulate to support confidence and economic stability during crisis episodes.[17]

The ECB collaborates with the European Commission on the EU Preparedness Union Strategy, which emphasises the role of cash in strengthening societal resilience. We also work closely with the NCBs to enhance crisis preparedness and ensure that cash remains available during emergencies. The recent power blackout in the Iberian Peninsula once again demonstrated that cash, being independent of technology, can always be relied on.

Modernising euro banknotes for the next decades

To safeguard the integrity of euro banknotes and ensure their continued relevance in a changing world, the ECB has embarked on their redesign. Besides bearing modern designs that resonate with Europeans, the redesigned banknotes will have advanced security features to combat counterfeiting.[18]

Both the public and experts from across Europe are actively involved in this project. By regularly seeking input from Europeans, we ensure that the new banknotes will represent the people who use them. As part of this process, the ECB has recently launched a design contest for future euro banknotes.[19]

This drive to modernise euro banknotes highlights our steadfast commitment to the future of cash. By enhancing security and aesthetic appeal, we aim to ensure that cash remains a trusted store of value and a widely used means of payment – both today and in an increasingly digitalised future.

Conclusion

We are fully committed to cash and are working to ensure that it remains widely available and accepted. And rest assured: a digital euro will not replace banknotes and coins but rather complement them, offering a “digital expression of cash”[20] that expands the benefits of cash to digital payments. The availability of cash in both physical and electronic form will strengthen Europe’s autonomy in payments. With a digital euro alongside cash, Europeans will benefit from a broader range of payment methods. They will be able to use central bank money for nearly all types of payments, including online transactions, and they will benefit from enhanced safety, security, efficiency, privacy and inclusivity.

As we move forwards, euro area consumers will appreciate having banknotes, coins and digital euros in their wallets – all with legal tender status, accessible anytime and anywhere, and tailored to diverse payment preferences and scenarios. Cash will therefore remain highly relevant and will exist alongside other means of payment. Particularly in times of crisis, cash can serve the public’s critical needs that alternatives cannot fully replace. In short: cash is here to stay.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

Between 2019 and 2024 the share of cash used at physical point of sale locations fell from 72% to 52% in terms of volume, and from 47% to 39% in terms of value. See ECB (2024), Study on the payment attitudes of consumers in the euro area (SPACE).

Clipal, R. and Zamora-Pérez, A. (2025), “Cash is alive… and somewhat young? Decoupling age, period and cohort from euro cash use”, Economic Bulletin, Issue 5, ECB. See also Panetta, F. (2021), “Cash still king in times of COVID-19”, keynote speech at the Deutsche Bundesbank’s 5th International Cash Conference – “Cash in times of turmoil”, 15 June.

Having the option to pay with cash remains very or fairly important for 62% of the euro area population. See ECB (2024), op. cit.

See European Commission (2023), “Single Currency Package: new proposals to support the use of cash and to propose a framework for a digital euro”, press release, 28 June.

See, for instance, Cipollone, P. (2025), “The digital euro: legal tender in the digital age”, introductory statement at the Committee on Economic and Monetary Affairs of the European Parliament, 14 July.

Zamora-Pérez, A. (2021), “The paradox of banknotes: understanding the demand for cash beyond transactional use”, Economic Bulletin, Issue 2, ECB, Frankfurt am Main.

As of June 2025.

See “Banknote production and stocks” on the ECB’s website, and Panetta, F. (2020), “Beyond monetary policy – protecting the continuity and safety of payments during the coronavirus crisis”, The ECB Blog, 28 April.

Proposal for a regulation of the European Parliament and of the Council on the legal tender of euro banknotes and coins, COM(2023) 364 final.

Zamora-Pérez, A. (2022), “Guaranteeing freedom of payment choice: access to cash in the euro area”, Economic Bulletin, Issue 5, ECB, Frankfurt am Main.

ECB (2024), op. cit.; ECB (2024), Use of cash by companies in the euro area in 2024.

Opinion of the European Central Bank of 13 October 2023 on a proposal for a regulation on the legal tender of euro banknotes and coins (CON/2023/31).

Council of the European Union (2025), Progress Report on the Single Currency Package, Brussels, 13 June.

In its Opinion of 13 October 2023, the ECB stated that “no cash practices”, i.e. unilateral exclusions of cash payments by enterprises in advance, are fundamentally incompatible with the legal tender status of euro banknotes and coins.

Section 2 of the ECB Opinion of 13 October 2023.

See Faella, F. and Zamora-Pérez, A. (2025), “Keep calm and carry cash: lessons on the unique role of physical currency across four crises”, Economic Bulletin, Issue 6, ECB, forthcoming.

ECB (2025), “ECB launches design contest for future euro banknotes”, press release, 15 July.

Graphic designers resident in the European Union are invited to participate in the design contest for future euro banknotes. Applications must be submitted by 18 August 2025. A group of independent experts will evaluate the proposals and select up to five per theme. After the contest finishes, the public will be invited to provide feedback on the designs selected. The ECB’s Governing Council is expected to decide on the final design by the end of 2026.

Lagarde, C. (2025), ECB Press Conference, 24 July.