- THE ECB BLOG

Tariffs: are workers more worried about their jobs?

10 October 2025

Do European workers see US tariff hikes as a threat to their job security? According to an ECB survey, while most workers are fairly relaxed, those in export-oriented sectors and those with lower incomes are more worried about their jobs than before the tariff increase.

Trade tariffs between the euro area and the United States increased significantly this year.[1] These tariffs increase the price of goods produced in Europe for customers in the United States. They are likely to reduce demand for European goods and prompt some firms on our side of the Atlantic to scale down their operations and workforce. This means that trade tensions could become a job killer for the euro area.

The ECB Consumer Expectations Survey asked all employed respondents in July how the recent US trade tariff announcements have affected the likelihood that they would lose their current job. This blog post examines how workers perceive the impact of tariff increases on their job security. The findings are valuable information for our understanding of the labour market, and ultimately also household spending. The lower the perceived job security, the greater the likelihood that workers will put money aside and reduce their consumption.[2]

Most workers are not more worried than before

Tariffs work like taxes by increasing the prices of imported goods. This applies both to goods used by US firms for their production, such as car parts, and the goods consumers buy directly, such as pharmaceuticals. Tariffs therefore make products from outside the United States more expensive and less competitive on the US market. As a result, firms and consumers might switch to other producers and demand fewer European goods (see also this edition of The ECB Blog). European firms that export a considerable amount of their goods to the United States might in turn then decide to reduce their workforce. In this way, tariffs can affect the job security of European workers.

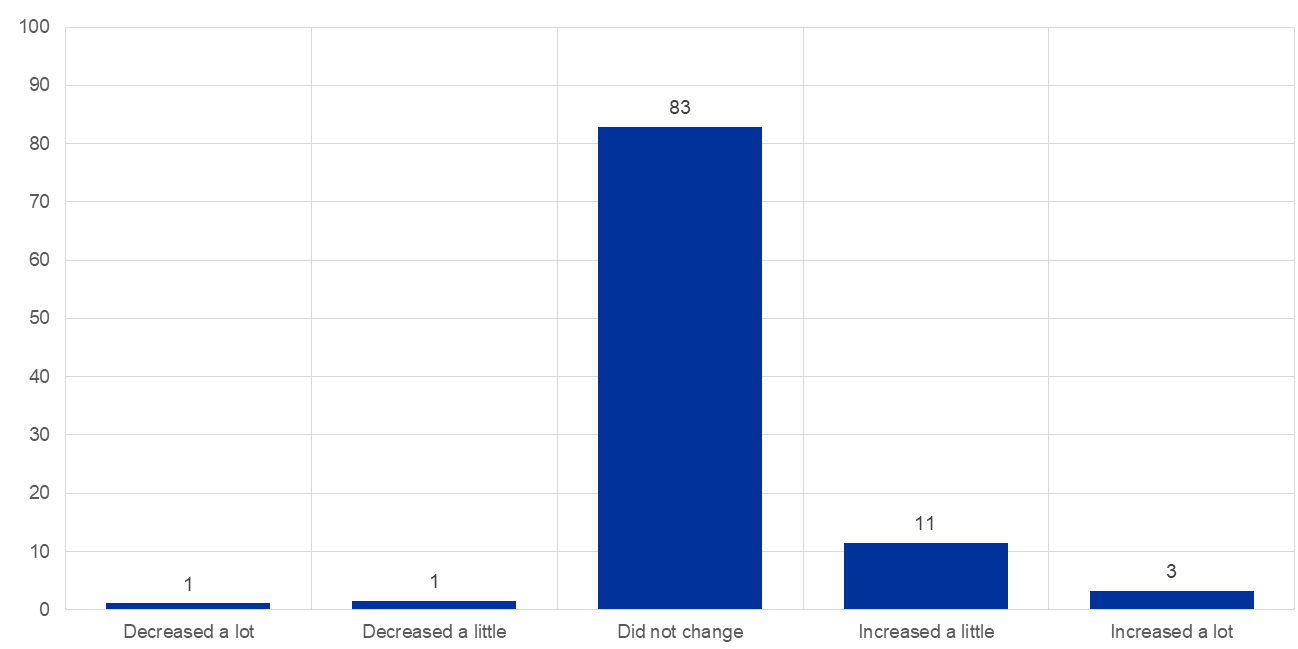

Despite these potential risks, most European workers aren’t too worried. On average, most do not consider their job stability to be affected by US tariffs (see Chart 1). We asked them: “Considering the sector you work in, how have the US tariff announcements affected the chance that you will lose your job?” In fact, 85% of all workers report unchanged or even lower job loss expectations following the increase in US tariffs. This might be because their employers would not be directly affected by a lower demand from US consumers. However, the picture is different for about 15% of workers. This group does perceive a higher probability of job loss, with 3% even stating that the chance of losing their jobs had increased a lot.

Chart 1

Expectations of job loss following the US tariff announcements

(percentages)

Source: ECB Consumer Expectations Survey (CES).

Note: Workers were asked the following question: “Considering the sector you currently work in and your current occupation, how have the recent US trade tariff announcements affected the percentage chance that you will lose your current job?”.

Workers in export-oriented sectors are more worried

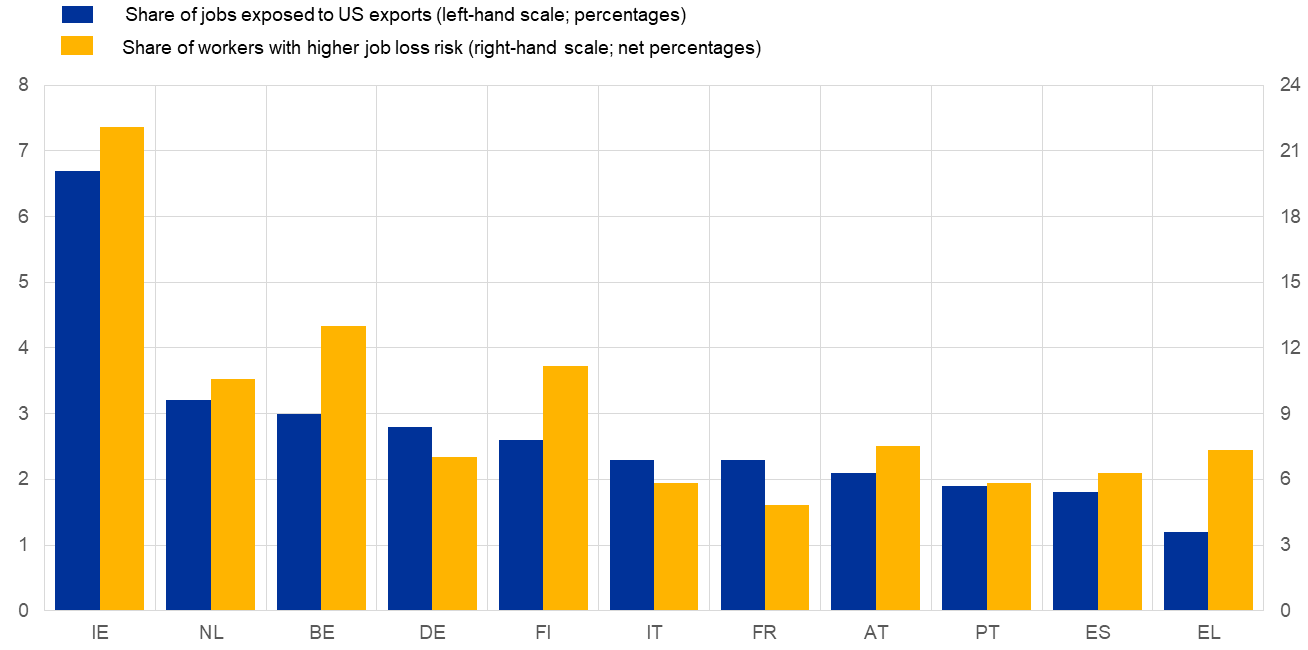

Workers in countries and sectors that export more to the United States perceive a higher job risk. However, firms with direct US business relations are less prominent than one might naturally assume. According to European Commission calculations the share of firms and jobs directly linked to US exports ranges from just above 1% in Greece to 6.7% in Ireland (see Chart 2). We compare this to the net percentage of workers perceiving an increase in their job loss expectations relative to workers perceiving a decrease.[3] Unsurprisingly, the share of workers more afraid of job loss is higher in countries in which the workforce is more exposed to US exports, such as Ireland.

Chart 2

Share of jobs exposed to US exports and share of workers expecting a higher job loss risk by country

(percentages and net percentages)

Sources: ECB Consumer Expectations Survey (CES) and Quarterly review of employment and social development in Europe (European Commission).

Notes: Workers were asked the following question: “Considering the sector you currently work in and your current occupation, how have the recent US trade tariff announcements affected the percentage chance that you will lose your current job?”. Net percentages are a weighted difference of the share of workers replying that they expect their job loss probability to “increase a lot/little” and those who expect it to “decrease a lot/little”. The share of jobs exposed to US exports is estimated based on the available data in the European Commission’s publication.

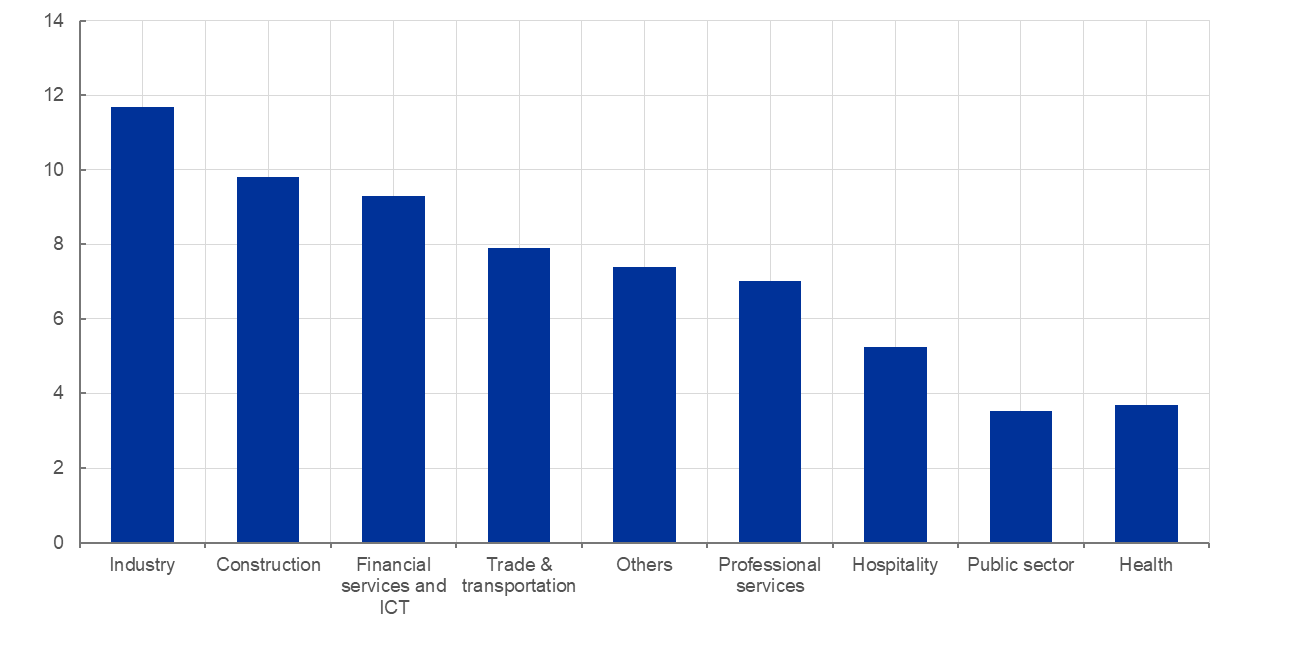

Taking an even closer look, we see that workers in more trade-oriented and cyclical sectors – currently under pressure of other shocks such as high energy prices – are more likely to perceive an increasing risk of job loss following the increase in US tariffs. Specifically, workers in industry, construction or trade feel more negatively affected by those tariffs (see Chart 3). These sectors are either more reliant on US exports or generally more prone to upswings and downswings. By contrast, workers in the public or health sectors do not usually sell their services to US customers. Demand for their services is also largely independent of overall economic conditions. Accordingly, the CES results show that workers in these sectors are much less concerned about their jobs following the tariff hikes. Workers in the financial services and ICT sectors are also more exposed to US tariffs and report higher job fears. This is especially the case for workers in Ireland and the Netherlands, which host the European headquarters for many US firms and are very open economies.[4] This means that workers in these countries are more vulnerable to stricter trade policies.

Chart 3

Change in job loss expectations in response to US tariffs by sector

(net percentages)

Source: ECB Consumer Expectations Survey (CES).

Notes: Workers were asked the following question: “Considering the sector you currently work in and your current occupation, how have the recent US trade tariff announcements affected the percentage chance that you will lose your current job?” Net percentages are a weighted difference of the share of workers replying that they expect their job loss probability to “increase a lot/little” and those who expect it to “decrease a lot/little”.

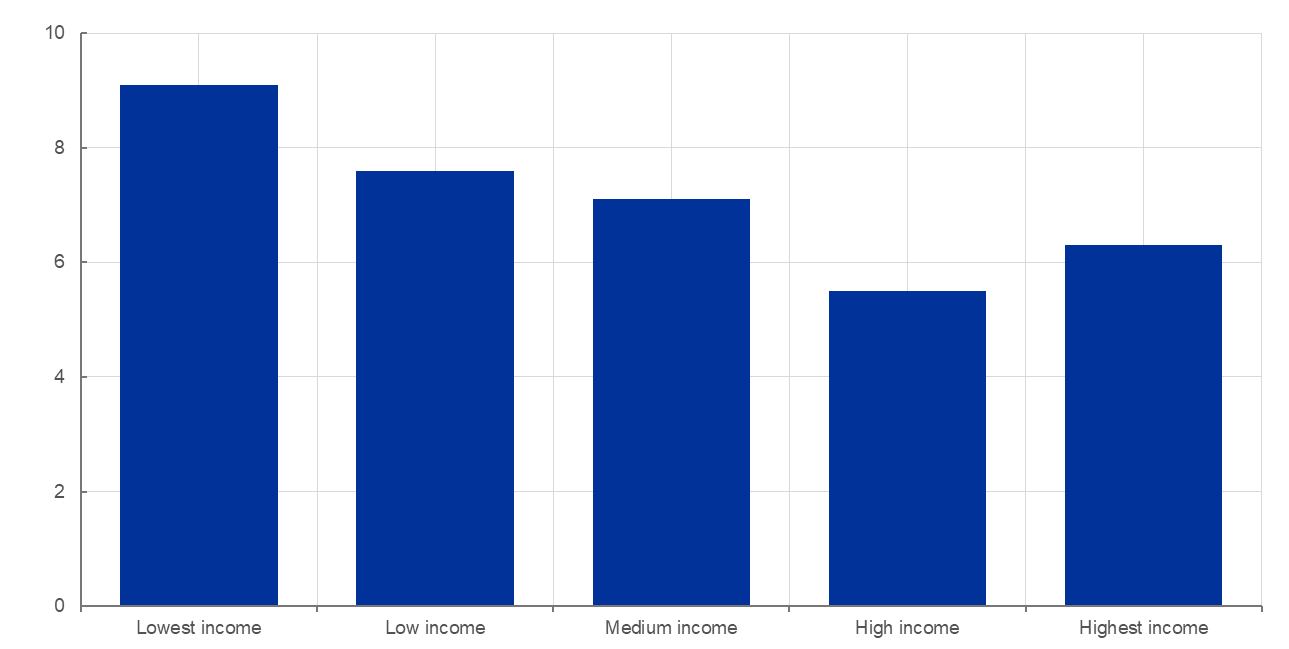

Additionally, low-income workers feel more at risk than their peers – especially in goods producing sectors. This is mostly due to their stronger exposure to the manufacturing sector, where tariffs have a more negative impact. However, deteriorating job prospects can also worsen the economic outlook for others, as workers who expect to lose their jobs reduce their spending as a precaution. We can observe this in the euro area: in particular, low-income households have reduced their spending on discretionary goods in expectation of a worsening economic situation and higher prices (see this recent ECB Economic Bulletin box). This may lead to lower demand and further worsen the labour market situation – including for firms and workers not directly affected by US tariffs.

Chart 4

Change in job loss expectations in response to US tariffs by income

(net percentages)

Source: ECB Consumer Expectations Survey (CES).

Notes: Workers were asked the following question: “Considering the sector you currently work in and your current occupation, how have the recent US trade tariff announcements affected the percentage chance that you will lose your current job?” Net percentages are a weighted difference of the share of workers replying that they expected their job loss probability to “increase a lot/little” and those who expect it to “decrease a lot/little”. Income is measured in quintiles.

Workers generally perceive that the sharp increase in tariffs on euro area exports to the United States is unlikely to affect their jobs. This seems reasonable, since most jobs are not directly exposed to US exports, and firms have other options for coping with tariff hikes beyond cutting employment. Nonetheless, some workers in more exposed sectors reported an increase in their job loss expectations. This matters when it comes to assessing the broader economic consequences of tariffs. Past research shows that workers who expect to lose their jobs are more likely to actually lose them later. Hence, while the direct impact of US tariffs on jobs appears to be limited, their impact on some workers can be stronger and might add further drag to firm and consumer confidence.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

Check out The ECB Blog and subscribe for future posts.

For topics relating to banking supervision, why not have a look at The Supervision Blog?

On 27 July 2025 the European Union and the US agreed on a new tariff ceiling of 15%. While for many goods higher tariff levels were announced in early April, the new ceiling is much higher than the average tariffs that prevailed previously. As the survey fieldwork largely took place before the announcement of the agreement at the end of July, repeating this question in the future would allow us to see if workers have changed their assessment since.

Dias da Silva, A., Rusinova, D. and Weissler, M. (2025), Consumption effects of job loss expectations: new evidence for the euro area. European Economic Review 179.

Workers replying that they expect their job loss probability to “increase/decrease a little” are weighted by 0.5, while those replying that they expect their job loss probability to “increase/decrease a lot” are weighted by 1.