Activity and price discovery in euro area inflation-linked swap markets

Published as part of the ECB Economic Bulletin, Issue 5/2025.

1 Introduction

Inflation-linked swap (ILS) rates are an important measure of private agents’ inflation expectations. Inflation expectations play a central role in the conduct of monetary policy at the ECB, whose primary objective is to maintain price stability in the euro area. These expectations matter as they influence private agents’ consumption and investment decisions, wage and price setting and consequently actual inflation. Among the different measures of private agents’ inflation expectations that are monitored by the ECB, the inflation compensation required by informed investors in financial markets plays an important role. As informed investors use financial products to hedge their exposure to, or express their views on, future inflation, the prices for those products can provide useful and particularly timely indications of possible shifts in the inflation outlook. In the euro area, the rates on ILS contracts – i.e. products that exchange a fixed payment in return for realised inflation over a given horizon in the future – are the most prominent market-based measures of inflation compensation in the monitoring toolkit for monetary policy purposes.[1]

Euro area ILS rates have been remarkably stable of late, following their most protracted period of high and volatile readings on record (Chart 1). ILS rates in the euro area started to increase rapidly across maturities in late 2021 to either reach, or fall only marginally short of, all-time highs in the period of high inflation in the two subsequent years, before retracing amid significant volatility that lasted well into 2023. Following these large and volatile moves, euro area ILS rates have remained remarkably stable and close to the ECB’s inflation target since 2024, including throughout the ECB’s monetary policy easing cycle.

This article presents evidence on activity and price discovery in – and hence the information content of – the euro area ILS market, in particular during the recent period of high inflation. The exceptional developments in inflation seen between 2021 and 2023 resulted in greater attention being paid to inflation expectations, and hence to euro area ILS rates, which displayed equally exceptional dynamics. While the latter might readily be rationalised by the parallel developments in realised inflation, some observers expressed concerns about the information content of ILS markets in the euro area. Specifically, such concerns related to market imperfections and “technical” factors that might have a negative impact on the quality of price signals received from euro area ILS markets. Such technical factors were summarised previously and, using an indirect approach, found to generally possess little explanatory power for euro area ILS rates (Munch Grønlund et al., 2024). This article adds to and supports those previous findings by drawing direct evidence from transactions data, based on aggregate market activity and the implications of underlying sectoral activity patterns for price discovery.[2]

Chart 1

Euro area ILS forward rates, selected maturities

(percentages per annum)

Sources: LSEG and ECB calculations.

Notes: The 1y4y ILS rate denotes the one-year forward rate starting in four years. The other ILS forward rates are defined accordingly. The latest observations are for 9 July 2025.

2 EMIR: evidence on euro area inflation-linked swap markets from derivatives transactions data

The analysis in this article uses transactions data collected under the European Market Infrastructure Regulation (EMIR).[3] EMIR was adopted by the EU in 2012 to increase transparency in derivatives markets by imposing mandatory reporting requirements on all EU-located entities for both over-the-counter and exchange-traded derivatives transactions. The data are reported centrally to the European Securities and Markets Authority. Relevant subsets are then distributed to various authorities within the EU, depending on their mandate and jurisdiction. The regulation on access to EMIR data means that, in ECB analysis and hence for the purposes of this article, all transactions considered involve at least one counterparty, trading venue or central clearing counterparty domiciled in the euro area.[4]

Following enrichment of EMIR data with complementary information, the dataset used here makes it possible to assess how both activity and price discovery in the euro area ILS market have evolved over time. The scope of the subset of EMIR data available to the ECB means that trades conducted entirely between non-euro area counterparties are not visible to the ECB. This limitation is important, as market intelligence suggests that a non-negligible share of activity in euro area inflation-linked (and other) derivatives is intermediated by non-euro area entities, most prominently counterparties based in the United Kingdom. It is therefore not possible to provide an exact picture of the full level of euro area ILS market activity.[5] However, even after an extensive and conservative procedure of filtering and cleaning, a substantial amount of euro area ILS trading activity remains visible, in the form of more than 200,000 transactions used in this analysis. This makes it possible to draw meaningful conclusions on any significant changes in activity overall and – after enrichment with complementary data – on the product, maturity and sector of the counterparties involved.[6]

The article benchmarks the period of higher and more volatile euro area ILS rates since 2021 against the calmer period that preceded it. Specifically, the article considers data from January 2018 to April 2024. The start date in January 2018 reflects the fact that it took some time for data quality to reach a satisfactory level after the EMIR reporting obligation came into force in 2014. The end date in April 2024 was chosen to ensure consistency over time, as reporting requirements changed when the EMIR Refit entered into force on 29 April 2024. While the choice of sample period thus partly reflects technical considerations, it also aims to broadly cover two economically distinct subperiods: (i) that of relatively low and more stable ILS rates until 2020; and (ii) that of higher and/or more volatile ILS rates since 2021.

3 Market activity

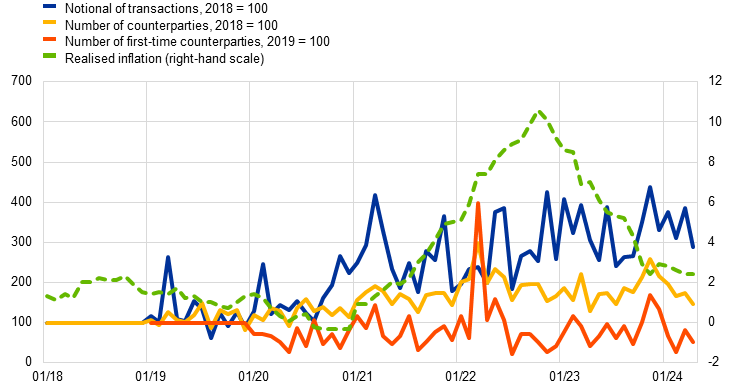

Overall activity in euro area ILS markets has increased considerably since around 2021 (Chart 2). This is evidenced by the notional amount involved in new euro area ILS transactions, which represents the most basic metric of aggregate activity (alongside the number of transactions). The metric did not show much of a structural increase between early 2018 and late 2020. It then picked up markedly alongside the significant rise in realised inflation rates in 2021 and remained consistently elevated up to April 2024. To give a sense of magnitude, at the respective peaks of activity, the (measured) monthly notional traded in euro area ILS contracts exceeded €150 billion, roughly quadrupling from its 2018 average.[7]

Moreover, the breadth and depth of participation in the market have recently been consistently greater than earlier in the sample. This conclusion is drawn from two observations. First, the number of identifiable counterparties involved in at least one transaction in a given month has risen over time and remained at a visibly higher level after 2021. Second, the number of counterparties that conducted their first in-sample transaction in a given month – a rough proxy for “market entry” – did not show a trend decline despite the passage of time.[8] In fact, this proxy even peaked in early 2022, coinciding with − and potentially related to − the volatility in commodities markets in the wake of Russia’s full-scale invasion of Ukraine. Taken together, these patterns suggest that euro area ILS markets saw a trend increase in activity that was rooted in ever wider investor participation.

Chart 2

Indicators of euro area ILS market activity and realised inflation

(left-hand scale: index, right-hand scale: percentages per annum)

Sources: ECB (EMIR), Eurostat and ECB calculations.

Notes: The gross notional amount and the number of counterparties with at least one transaction in a given month are indexed to 100, where 100 represents the average monthly level in 2018. For the number of first-time counterparties, the indexing is based on the monthly average over 2019. The latest observations are for April 2024.

Further information about the maturity of the market can be obtained by breaking down activity across different ILS product types and maturities. Euro area ILS contracts fall into three broad categories. First, in a spot contract, the cash flows of the floating leg of the transaction depend on the average rate of inflation over often a number of years, starting from the date of execution. Second, in a forward contract, cash flows equally depend on the average rate of inflation over up to a number of years, but start from an effective date (notably) later than the date of execution. Third, in a short-term inflation “fixing” contract, cash flows depend on the year-on-year rate implied by upcoming inflation releases.[9] As a new element of the ECB’s analysis of the ILS market, this article first reports the shares of activity in euro area ILS markets accounted for by these three categories.[10] This may help assess whether the notable increase in overall activity should be seen as taking place in a mature market or as simply one of many parameters in flux in a market that is still developing. In the first case, activity shares across products and the respective underlying maturities might be expected not to change too much and/or too rapidly over time, whereas in the second case more significant changes would be expected.

Chart 3

Share of gross notional traded in the euro area ILS market

a) By product type | b) Spot transactions, by maturity |

|---|---|

(percentages) | (percentages) |

|  |

Sources: ECB (EMIR), LSEG and ECB calculations.

Notes: Panel a) shows the distribution of gross notional traded across ILS spot, forward and inflation fixing transactions between January 2018 and April 2024. Panel b) zooms in on the largest of the three categories (i.e. ILS spot transactions) by maturity, sorted by importance and relevance. Other maturities, some of which command a higher share of activity than the 20-year, 15-year and 30-year points, are subsumed in the related category. The minimum-maximum range is based on yearly shares of gross notional traded.

Euro area ILS market activity almost exclusively comprises spot transactions, with the lion’s share of activity concentrated in maturities that feature prominently in monitoring for monetary policy purposes. Chart 3, panel a) shows that, structurally, trading in euro area ILS markets focuses almost entirely on spot transactions, with the corresponding notional accounting for around 98% of total notional over the full sample. By contrast, outright forward and inflation fixing transactions represent only very small shares of around 1% each. Crucially, the fact that market participants hardly trade forward contracts outright does not make key euro area ILS forward rates that are being monitored for monetary policy purposes any less useful. In fact, among spot ILS contracts (Chart 3, panel b), activity is centred on the five-year, ten-year, two-year and one-year maturities (in that order, based on full-sample notional shares). Forwards derived from these spot maturities – e.g. the five-year/five-year and one-year/one-year forward rates that serve as proxies for the anchoring of long-term inflation expectations and expectations for medium-term inflation, respectively – can therefore be considered particularly informative.

The stability in activity across both product types and maturities suggests that euro area ILS trading bears the hallmarks of a mature market. The observation that trading almost exclusively reflects spot transactions also holds true for individual years, as the respective notional shares deviate only marginally from their full-sample averages (not shown). Moreover, the rankings among the most active maturities in the spot category have remained relatively similar over time. This is the case when comparing the 2018-20 and 2021-24 subperiods, as well as when looking at the variation of activity shares across maturities across the individual years in the sample (see the min-max range in Chart 3, panel b). It therefore seems that, within a market that has been in existence for around two decades, participants in euro area ILS transactions flock to established products and maturities to hedge their exposure to, or express their views on, future inflation.

Trading activity in inflation fixing contracts represents a notable exception, having increased disproportionately during the period of high inflation. While inflation fixing contracts accounted for less than 2% of traded notional on average, their share of activity roughly doubled across the 2018-20 and 2021-24 subperiods amid increasing overall activity. As a result, total fixing contract activity is estimated to have increased about fivefold, compared with other ILS transactions roughly doubling.[11] The particularly pronounced increase for fixing contracts likely reflects a heightened focus and potential for speculation on specific inflation releases that are seen as a bellwether in an environment of high and volatile inflation. At the very least, significantly higher fixing contract activity suggests that price discovery for these products improved during the period of high inflation.

4 Price discovery

The increases in a number of activity metrics may be considered encouraging also from the point of view of price discovery, but a more robust assessment of the process requires further evidence. Price discovery, loosely understood as the process by which buyers and sellers establish the “appropriate” price of a security or contract, likely benefits from an increase in the number and volume of transactions, all else equal.[12] In particular, the rise in the breadth and depth of investor participation in euro area ILS markets may be considered positive in this regard. For a more stringent assessment, however, one might wish to consider at least two additional dimensions. First, the stronger the relationship between activity levels and instances of repricing, the more sound the price discovery process may be deemed to be.[13] Second, the more prominent the role played by “informed” investors for a given level of activity, the more prices might be expected to reflect “fundamentals”.[14]

Aggregate activity patterns point to healthy price discovery, as days with the most significant changes in euro area ILS rates command a disproportionate share of activity. This is the finding from an empirical test that analyses the distribution of traded notional in euro area ILS markets across buckets capturing the strength of daily changes in euro area ILS rates. Specifically, Chart 4 sorts the days in the sample by the respective changes in the euro area five-year ILS spot rate – in ascending order from decreases to increases – before assigning these changes to buckets based on various percentiles.[15] The chart shows that the 1% of days in-sample with, respectively, the most pronounced decreases and increases of euro area ILS rates each account for around 2% of notional traded. This implies a ratio of the share of notional to the share of days of close to two for each of these two buckets. Intuitively, higher ratios imply relatively more robust support from underlying activity. Looking at wider buckets of successively less pronounced daily changes in ILS rates, that ratio declines before falling visibly below one for the bucket containing the least eventful 50% of daily changes in ILS rates. This reflects the fact that those days between the 25th and 75th percentiles of the distribution of daily changes in the euro area five-year ILS rate represent less than 40% of notional traded. Overall, this suggests there is a reasonably strong relationship between activity levels and instances of repricing, and thus a healthy price discovery process.

Chart 4

Share of gross notional traded, by size of daily change in euro area ILS rates

(left-hand scale: percentages, right-hand scale: ratios)

Sources: ECB (EMIR), LSEG and ECB calculations.

Notes: The chart divides the January 2018 to April 2024 sample into buckets of daily changes in the euro area five-year ILS rate, sorted by size. The “<p1” bucket contains the 1% of observations with the largest daily decreases, while the “>p99” bucket contains the 1% of observations with the largest daily increases. Blue bars show the share of full-sample gross notional traded in euro area five-year ILS contracts that is accounted for by each of the buckets, while the yellow line shows the ratio of that share to the share of days in each bucket (i.e. 1% for <p1, 4% for p1-p5, etc.).

Sectoral activity analysis further strengthens the case for price discovery in line with “fundamentals” in the period of high inflation, as the share of activity stemming from more informed and responsive counterparties increased markedly. The intuition for analysing the sectoral composition of activity is that prices are more likely to reflect fundamentals – understood here in the broad sense of any information relating to the inflation outlook – the higher the share of activity coming from investors that closely follow macroeconomic developments and trade swiftly upon re-assessing their inflation outlook.[16] In an environment where that share is high, the “marginal investor” in a given trade is more likely to be an informed and responsive counterparty that helps anchor the acceptable price around an up-to-date assessment of the inflation outlook.

In this respect, the hedge fund sector is of particular interest. Conventional wisdom suggests that, among the different sets of counterparties active in the euro area ILS market, (global macro) hedge funds and, to a lesser extent, investment funds are most likely to be both attentive and responsive to macroeconomic developments. This hypothesis receives empirical support from the evidence presented in Box 1, which examines differences in the activity of counterparty sectors in the euro area ILS market in response to “fundamental” shocks of varying strength.

Box 1

The responsiveness of counterparties in the euro area inflation-linked swap market

Conceptually, counterparties active in the euro area inflation-linked swap (ILS) market (and financial markets more generally) can be ranked along a spectrum of responsiveness. At one end of this spectrum, highly responsive counterparties follow the flow of macroeconomic and general news closely and at high frequency, but these are also prepared to trade swiftly in response. At the other end, even counterparties that might well follow the news flow similarly closely will trade to a more regular schedule, such that their responses only reflect any possible changes in assessment due to incoming information with a meaningful lag.

In a stylised view, conventional wisdom would see hedge funds populating the responsive end of this spectrum, whereas insurance corporations and pension funds represent the less responsive end, with most investment funds sitting somewhere in between. Depending on the financial market and counterparties involved, however, the sorting of counterparties into sectors may prove noisy. In other words, counterparties whose name suggests they belong to one sector may demonstrate behaviour that would generally be associated with another sector.[17]

This box shows that, in the dataset used in the associated article, counterparty behaviour across sectors does align reasonably well with the stylised priors. The identification strategy behind this conclusion is as follows:

The fact that days with more significant changes in euro area ILS rates tend to account for a disproportionate share of aggregate activity (see Chart 4 and the associated discussion in the main text of this article) suggests that both ILS rate changes and activity levels are driven by a common “fundamental” shock. Accordingly, the strength of ILS rate changes can serve as a rough “instrument” proxying for the relevance of the shock. Then, as any differences in responsiveness across counterparties should be particularly visible in the case of more relevant shocks, one would expect the activity of sectors hypothesised as more responsive to pick up disproportionately on days with more pronounced changes in ILS rates.

The stylised priors are confirmed from two angles.[18]

First, on days for which the strength of euro area ILS rate changes points to particularly relevant shocks (i.e. below the 10th and above the 90th percentiles), the notional traded by identified non-bank counterparties stems mainly from the hedge fund sector (Chart A).[19] This contrasts markedly with days of less pronounced ILS rate changes and hence presumably less relevant shocks. It is also worth noting that, in a mirror image of the shares accounted for by the hedge fund sector across buckets, those of insurance corporations and pension funds are inversely related to shock relevance.

Chart A

Sectoral composition of gross notional traded, by size of daily change in euro area ILS rates

(percentages)

Sources: ECB (EMIR, RIAD), GLEIF, Bloomberg and ECB calculations.

Notes: The chart divides the January 2018 to April 2024 sample into buckets of daily changes in the euro area five-year ILS rate, sorted by size. The “<p10” bucket contains the 10% of observations with the largest daily decreases, while the “>p90” bucket contains the 10% of observations with the largest daily increases. Stacked bars show, for each bucket, the shares of notional accounted for by the different sectors in transactions of all euro area ILS contracts on days belonging to the bucket. Shares rescaled following the exclusion of notional traded by banks and unidentified counterparties in the sample.

Second, in an arguably more stringent test of sectoral responsiveness, Chart B shows an activity profile for each sector. This profile is obtained by computing, for each ILS rate change bucket, the ratio of (i) the share of a sector’s total in-sample notional that was traded on days belonging to the bucket, and (ii) the share of days covered by the bucket. Consistent with the thinking on aggregate price discovery, sectors thought to be more responsive should exhibit a more V-shaped profile. This is indeed the case, as the profile of the hedge fund sector is clearly the most V-shaped, followed by that of the investment fund sector and that of the insurance corporation and pension fund sector.

Chart B

Relative activity profiles, by sector and by size of daily change in euro area ILS rates

(ratios)

Sources: ECB (EMIR, RIAD), GLEIF, Bloomberg and ECB calculations.

Notes: The chart divides the January 2018 to April 2024 sample into buckets of daily changes in the euro area five-year ILS rate, sorted by size. The “<p10” bucket contains the 10% of observations with the largest daily decreases, while the “>p90” bucket contains the 10% of observations with the largest daily increases. Lines show, for each sector, the profile of a ratio calculated as follows for each bucket: the share of the sector’s total in-sample notional that was traded in all euro area ILS contracts on days belonging to the bucket, divided by the share of days covered by the bucket.

The hedge fund sector is also the one that has significantly increased its share of activity in the euro area ILS market in recent years. Chart 5 shows the evolution of activity shares attributable to different counterparty sectors. For the purposes of this discussion, the chart excludes two types of counterparty: banks, through which almost all euro area ILS market activity continues to be intermediated; and unidentified counterparties.[20] Leaving aside these two, the share of remaining gross notional accounted for by hedge funds has risen significantly, from less than 20% in 2018 to around 50% from 2021 onwards. Hence, an increasing share of activity in the euro area ILS market has come from investors that more frequently update their views on the inflation outlook and swiftly execute transactions based on those views. This means that, if anything, the information content of euro area ILS rates is likely to have risen in recent years.[21]

Chart 5

Share of gross notional traded, by sector

(percentages)

Sources: ECB (EMIR, RIAD), GLEIF, Bloomberg and ECB calculations.

Notes: The chart shows the gross notional traded in the euro area ILS market in a full given year (January to April in the case of 2024) by counterparties stemming from the hedge fund, investment fund, insurance corporation and pension fund, and other sectors. Shares rescaled following the exclusion of notional traded by banks and unidentified counterparties in the sample.

5 Conclusions

Derivatives transactions data suggest that the information content of euro area ILS markets is considerable and has, if anything, improved in recent years. This article presents the results of a detailed analysis of data reported under EMIR that provide first-hand, detailed evidence on the activity of counterparties in euro area ILS markets. The aim is to assess the information content of euro area ILS rates as measures of inflation compensation. The data point to a considerable increase in both the breadth and the depth of overall activity. The price discovery process resulting from trading activity appears healthy overall, and the sectoral composition of activity has shifted towards counterparties that can be deemed more responsive to changes in the inflation outlook. In particular, the share of activity attributable to the hedge fund sector has risen. All of this means that an increasing proportion of transactions in euro area ILS markets seems to have been underpinned by the continuous updating of views on the inflation outlook.

References

Barria, R. and Pinter, G. (2023), “Mispricing in inflation markets”, Staff Working Papers, No 1,034, Bank of England, August.

Boneva, L., Böninghausen, B., Fache Rousová, L. and Letizia, E. (2019), “Derivatives transactions data and their use in central bank analysis”, Economic Bulletin, Issue 6, ECB.

Böninghausen, B., Kidd, G. and de Vincent-Humphreys, R. (2018), “Interpreting recent developments in market-based indicators of longer-term inflation expectations”, Economic Bulletin, Issue 6, ECB.

Burban, V., De Backer, B., Schupp, F. and Vladu, A.L. (2022), “Decomposing market-based measures of inflation compensation into inflation expectations and risk premia”, Economic Bulletin, Issue 8, ECB.

Chahad, M., Hofmann-Drahonsky, A., Krause, W., Landau, B. and Sigwalt, A. (2024), “The empirical performance of ECB/Eurosystem staff inflation projections since 2000”, Economic Bulletin, Issue 5, ECB.

Clark, P.K. (1973), “A subordinated stochastic process model with finite variance for speculative prices”, Econometrica, Vol. 41, No 1, January, pp. 135-155.

Epps, T.W. and Epps, M.L. (1976), “The stochastic dependence of security price changes and transaction volumes: implications for the mixture-of-distributions hypothesis”, Econometrica, Vol. 44, No 2, March, pp. 305-321.

Ferrara, M.F., Linzert, T., Nguyen, B., Rahmouni-Rousseau, I., Skrzypińska, M. and Vaz Cruz, L. (2024), “Hedge funds: good or bad for market functioning?”, The ECB Blog, 23 September.

Harris, L. (1986), “Cross-Security Tests of the Mixture of Distributions Hypothesis”, The Journal of Financial and Quantitative Analysis, Vol. 21, No 1, March, pp. 39-46.

Kyle, A.S. (1985), “Continuous auctions and insider trading”, Econometrica, Vol. 53, No 6, November, pp. 1315-1335.

Munch Grønlund, A., Jørgensen, K. and Schupp, F. (2024), “The role of technical factors in euro area inflation-linked swap rates”, Economic Bulletin, Issue 3, ECB.

O’Hara, M. (2003), “Presidential Address: Liquidity and Price Discovery”, The Journal of Finance, Vol. 58, No 4, August, pp. 1335-1354.

Putniņš, T.J. (2013), “What do price discovery metrics really measure?”, Journal of Empirical Finance, Vol. 23, September, pp. 68-83.

For a fuller discussion, see Böninghausen et al. (2018).

This article considers ILS rates to have information content if they reflect, at any given point in time, the prevailing views on future inflation of informed investors. In turn, this is deemed to be more likely if these investors trade the associated contracts frequently and in response to relevant news. As such, the assessment of information content does not hinge on the historical inflation forecasting properties of ILS rates – see Chahad et al. (2024) for a comparison of the forecast performance of euro area inflation-linked products and ECB/Eurosystem staff projections. However, to the extent that investors have “skin in the game”, ILS rates that reflect investors’ views in timely fashion should also be expected to perform well in forecasting inflation.

Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (OJ L 201, 27.7.2012, p. 1).

In fact, and at the latest following the United Kingdom’s exit from the EU, this caveat also applies to the full EU-wide EMIR dataset.

In short, the extensive filtering and cleaning of the data is followed by (i) matching traded rates with quoted ILS rates to identify the type of ILS contract, and (ii) enrichment with company data from the Global Legal Entity Identified Foundation (GLEIF) and the ECB’s Register of Institutions and Affiliates (RIAD) databases as well as Bloomberg to eliminate intragroup transactions and allow for sectoral activity analysis.

The stated notional amount represents a probably considerable underestimation as the filtering procedure is conservative and euro area ILS trades conducted entirely between non-euro area counterparties are not included (see above).

The probability of observing a counterparty transact for the first time in-sample declines with every passing month. With the sample starting in January 2018, a very significant number of counterparties will, by definition, be first observed in that month. An elevated number of transactions identified as coming from “first timers” are to be expected in the immediately ensuing months. The actual data confirm these expectations, as the “rate of entry” starts stabilising around mid-2018. To account for this mechanical effect, Chart 2 indexes the number of first-time counterparties to 2019 levels rather than the 2018 levels used in the other series.

Strictly speaking, inflation fixing contracts are thus a form of spot or forward ILS contract. However, plain-vanilla ILS spot or forward contracts tend to have tenors and forward horizons in multiples of years measured from the execution date, whereas a fixing contract can be thought of as trading inflation rates anywhere between zero and less than 12 months (or more than 12 and less than 24 months) after the execution date.

See also Boneva et al. (2019), which presents initial findings on ILS market activity in the euro area based on an earlier, lower-quality snapshot of EMIR data. For instance, the less granular analysis did not address activity in inflation fixing contracts.

Note the emphasis on the increase in fixing contracts activity in particular being an estimate. In the absence of an identifier distinguishing fixing from other ILS contracts, there is considerable uncertainty about the true change in activity in any smaller segment of the overall market. To address this issue, the article employs a type of “radius matching” procedure of traded rates against quoted rates to identify those transactions that likely refer to inflation fixing contracts. While this procedure yields plausible results, notably larger variation in inflation compensation in recent years may play some role in a larger share of transactions being identified as fixing contracts. Due to this uncertainty, the article does not present more granular results on fixing contracts.

According to O’Hara (2003), price discovery is one of the two principal functions of financial markets, alongside providing liquidity. In spite of this, there are differences and a lack of precision in definitions of price discovery (Putniņš, 2013).

This notion is consistent with the “mixture-of-distributions” hypothesis set out by Clark (1973), Epps and Epps (1976) and Harris (1986). This hypothesis postulates that prices and trading volumes (i.e. activity levels) jointly depend on a common underlying variable, namely the rate of information flow. As new information arrives, traders react by both revising the appropriate price of the security in question and increasing their trading volume.

For a theoretical model on the beneficial role of informed traders, see, for instance, Kyle (1985).

Days are sorted by changes in the five-year euro area ILS rate because this is the single most actively traded maturity (Chart 3) and because ILS rate changes are highly correlated across maturities. This makes changes at the five-year maturity a good proxy for the strength of repricing in euro area ILS markets more generally.

As such, the inflation outlook as understood here is not limited to “genuine” expectations priced into ILS rates, but also includes the inflation risk premium. For a discussion of genuine inflation expectations and risk premia, see Böninghausen et al. (2018). For more information on model-based decompositions of ILS rates into these two components, see Burban et al. (2022).

See also Boneva et al. (2019).

The results of additional counterparty-level panel regressions are consistent with the findings reported here. Concretely, the hedge fund sector is the one whose ILS market activity most consistently increases on days of macroeconomic shocks and inflation releases, compared with other days. This sector’s activity also tends to increase by more than that of other (non-bank) sectors, such as investment funds or insurance corporations and pension funds.

While in Charts A and B the sample is sorted into buckets covering daily euro area five-year ILS rate changes of different magnitudes, the breakdown is less granular than in Chart 4 in the associated article. This is because Charts A and B take an additional sector point of view, which would lead to noisy results if, say, the 1st and 99th percentiles were considered.

Banks are dropped in the representation because their intermediation function makes them account for a dominant share of overall activity, which would make it harder to trace the evolution of activity by non-banks. Moreover, the (economically more interesting) part of bank activity that reflects position-taking based on views on the inflation outlook cannot be distinguished from intermediation activity on the basis of the available data.

Increasing hedge fund participation is not necessarily driven entirely by “absolute” pricing motives, i.e. where a hedge fund trades an ILS contract based on its views on future inflation. It may also be driven by “relative” pricing motives, i.e. where a hedge fund trades an ILS contract based on its assessment of the corresponding ILS rate relative to the price of a similar asset, such as an inflation-linked government bond. The significant increase in the trading of short-term inflation fixing contracts – in which hedge funds represent virtually all identifiable non-bank activity and which do not readily lend themselves to being priced relative to (generally longer-dated) inflation-linked bonds – is a clear sign that absolute pricing activity has risen. It seems plausible, however, that relative pricing motives may have played at least some role in the pick-up in hedge fund activity in euro area ILS markets, seeing as this sector has also substantially increased its trading activity in euro area government bond markets in recent years (Ferrara et al., 2024). Ultimately, the “true” motivation behind a trade is untestable, at least for as long as (matchable) data on transactions in the euro area cash government bond market remain unavailable. In this context, see Barria and Pinter (2023) on the arbitrage activity of hedge funds across ILS and government bond markets in the United Kingdom.