Published as part of the ECB Economic Bulletin, Issue 2/2025.

This box provides a comprehensive assessment of survey data on bank lending to euro area firms from the perspective of banks and firms. The euro area bank lending survey (BLS) and the survey on the access to finance of enterprises (SAFE) are long-standing surveys that provide qualitative information on credit supply and demand and interaction between them.[1] Both surveys offer important early indications of future trends in loan volumes and provide information on factors driving loan supply and demand. The BLS focuses on bank lending conditions, including their interactions with alternative sources of financing, as assessed by banks. The SAFE provides more detailed insights, based on the answers of firms, into the broader capital structure of firms. By combining findings from both the BLS and the SAFE, the surveys complement hard data on lending volumes and interest rates and enhance the interpretation of financial and economic conditions within the euro area.[2]

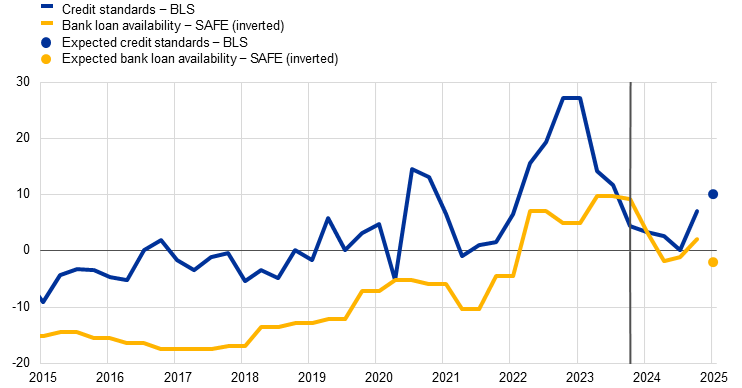

BLS credit standards and SAFE bank loan availability are conceptually closely related, and these evolve similarly (Chart A). Banks’ assessment of their credit standards (i.e. their loan approval criteria) in the BLS has broadly co-moved with firms’ perceptions of the availability of bank loans in the SAFE over the history of the two surveys. Still, in 2015-22 firms indicated a net improvement in bank loan availability, while banks’ assessments showed a more contained net easing of credit standards, with net percentages fluctuating around zero. Such differences in net percentages between BLS credit standards and SAFE bank loan availability signal differences between the risk assessments of banks and firms, indicating a stronger focus on credit risk among banks. Differences can also arise from changes in the composition of banks’ exposures to firms with specific risk profiles. More recently, during the monetary policy tightening cycle in 2022-23, both surveys showed a substantial tightening in credit supply, followed by a more moderate tightening over the first three quarters of 2024. In the fourth quarter of 2024, euro area banks indicated a renewed net tightening of their credit standards for firms in the BLS, which was echoed by firms reporting a renewed deterioration in bank loan availability in the SAFE.

Chart A

Changes in credit standards and bank loan availability for firms

(net percentages of banks reporting a tightening and net percentages of firms reporting a deterioration)

Sources: ECB (BLS), ECB and European Commission (SAFE) and ECB calculations.

Notes: For the BLS a positive value represents a net tightening of credit standards; for the SAFE a positive value represents a net decrease in bank loan availability. SAFE figures are inverted. The dots refer to expectations over the next three months (BLS and SAFE). The vertical line marks the fourth quarter of 2023, the period as of which results are directly comparable between the surveys on a quarterly basis.

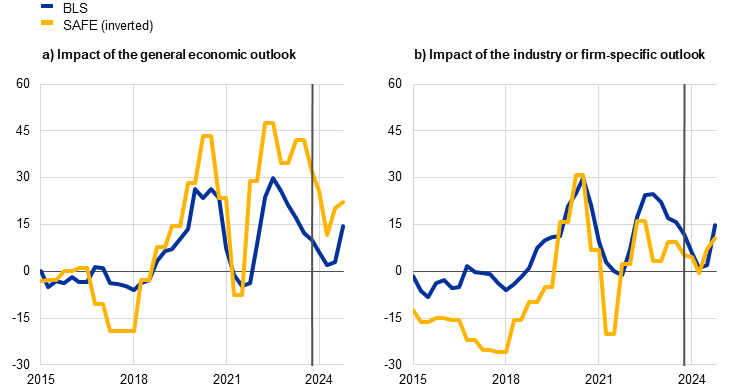

In both surveys, the general economic and firm-specific outlook are key drivers of credit standards and bank loan availability (Chart B). Banks and firms assess the impact of the general economic outlook on credit supply in a very similar way, closely linked to the cyclical swings in the euro area economy (Chart B, panel a). Banks’ and firms’ assessment of the impact of the industry or firm-specific outlook on credit supply also follows similar dynamics, but with firms reporting their own situation as tending to have a more positive impact on bank loan availability than is reported by banks (Chart B, panel b). This could be due to firms potentially focusing more on their long-term creditworthiness, while banks may concentrate more on the forward-looking assessment of credit risks for the industry and firms’ balance sheets. In the fourth quarter of 2024, both banks and firms mentioned the general economic outlook and the firm-specific outlook as important factors reducing the availability of bank loans.

Chart B

Impact of selected factors on credit standards and bank loan availability

(net percentages of banks reporting a tightening impact and net percentages of firms reporting a negative impact)

Sources: ECB (BLS), ECB and European Commission (SAFE) and ECB calculations.

Notes: See notes to Chart A. In panel b), the BLS indicator refers to the industry and firm-specific outlook, while the SAFE indicator refers to firms’ sales and profitability or business plans.

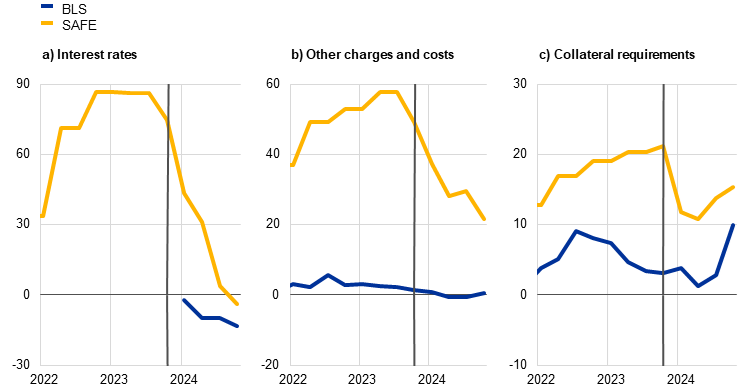

Price and non-price terms and conditions on loan contracts contribute to the understanding of credit dynamics, reflecting the interaction of loan supply and demand (Chart C). Terms and conditions can change owing to changes in interest rates, changes in financing costs other than interest rates – such as charges, fees and commissions – or through other non-price terms and conditions, such as collateral requirements. In the fourth quarter of 2024 both banks and firms reported that the decrease in interest rates was accompanied by a tightening in collateral requirements. Moreover, firms reported that financing costs other than interest rates continued to have a net tightening effect, while banks assessed their non-interest charges as being broadly unchanged.

Chart C

Changes in terms and conditions for loans to firms

(net percentages of banks and firms respectively reporting an increase or a tightening)

Sources: ECB (BLS), ECB and European Commission (SAFE) and ECB calculations.

Notes: For both the BLS and SAFE, a positive value is a net increase in interest rates or other charges and costs, or a net tightening of collateral requirements. Interest rates in the BLS refer to lending rates, which have been included since the first quarter of 2024. Other charges and costs are non-interest rate charges reported in the BLS and other financing costs reported in the SAFE. See Chart A for details of the vertical line.

Firms’ demand for bank loans in the BLS captures changes in demand as observed by banks, which are highly cyclical, whereas the SAFE reports the overall changes in firms’ need for bank loans to run their business, which are less cyclical (Chart D). In the BLS, the demand for bank loans refers to firms’ bank loan financing needs as observed by banks, regardless of whether these needs ultimately result in a loan.[3] In the SAFE, firms’ financing needs for bank loans reflect their own perceptions and assessment of their external financing requirements, which may not always lead to firms approaching a bank for a loan. Therefore, the SAFE indicator captures both the financing needs observed by banks and those that might otherwise go unnoticed, such as those of firms without any bank contact or those of discouraged borrowers. Another SAFE indicator provides information on the share of firms that applied for bank loans. Historically the BLS demand indicator has been more cyclical than the demand measures from the SAFE, which might be due to differences in how banks and firms assess demand. Banks might be more focused on the assessment of firms’ loan demand in the context of the general economic situation and business outlook, whereas firms focus more on their operations and business opportunities. Still, indicators from both surveys have pointed to a persistent weakness in loan demand from the end of 2022 until the fourth quarter of 2024, despite declining interest rates.

Chart D

Changes in BLS Ioan demand and bank loan financing needs and applications in the SAFE

(left axis: net percentages, right axis: percentages)

Sources: ECB (BLS), ECB and European Commission (SAFE) and ECB calculations.

Notes: On the left axis, for the BLS, a positive value is a net increase in loan demand at the bank; for the SAFE, a positive value is a net increase in firms’ need for bank loans. On the right axis, the percentages show the proportion of firms that applied for a bank loan relative to all firms for which bank loans are a relevant source of finance. See the notes to Chart A for details of the vertical line.

Overall, the BLS and SAFE results enrich the analysis of lending dynamics by providing additional insights through the lenses of banks and firms. Consequently, the surveys also enhance the interpretation of financial and economic conditions within the euro area. Concerning the most recent developments, in the fourth quarter of 2024 the BLS and the SAFE consistently signalled a renewed tightening in bank credit supply to firms in the euro area, which appeared to be driven by higher credit risks. In addition, banks and firms reported still muted demand developments.

For the BLS, see the article entitled “Happy anniversary, BLS – 20 years of the euro area bank lending survey”, Economic Bulletin, Issue 7, ECB, 2023. For the SAFE, see the article entitled “The Survey on the Access to Finance of Enterprises: monetary policy, economic and financing conditions and inflation expectations”, Economic Bulletin, Issue 7, ECB, 2024. The BLS is representative of euro area bank lending to firms and households, while the SAFE is representative of the overall population of firms in the euro area. The BLS has been conducted at a quarterly frequency since its inception in 2003. The SAFE, initiated in 2009 with a semi-annual schedule, transitioned to a quarterly frequency in the first quarter of 2024. This allows it to be effectively compared with the BLS. Both surveys are qualitative and ask banks/firms about changes in credit supply and demand. The analysis focuses on “net percentages”, defined as the difference between the share of banks or firms reporting a tightening/an increase and the share of those reporting an easing/a decrease. Therefore, net percentages should not be interpreted as being equivalent to growth rates, but rather as indications of the direction of changes.

For the BLS, see the box entitled “What information does the euro area bank lending survey provide on future loan developments?”, Economic Bulletin, Issue 8, ECB, 2022, and Altavilla, C., Darracq Paries, M. and Nicoletti, G., “Loan supply, credit markets and the euro area financial crisis”, Journal of Banking & Finance, Vol. 109, 2019. For the SAFE, see the box entitled “Firms’ access to finance and the business cycle: evidence from the SAFE”, Economic Bulletin, Issue 8, ECB, 2022, and the box on “Corporate vulnerabilities as reported by firms in the SAFE”, Economic Bulletin, Issue 1, ECB, 2024.

Based on their regular contacts with their existing corporate clients, banks in the BLS develop an assessment of the changes in firms’ financing needs, even when these firms are not reaching out to them. This is also reflected in banks’ replies on, for instance, the impact of alternative sources of financing on firms’ loan demand. In addition, banks may receive further signals from potential new clients, if these firms reach out to the banks.