Published as part of the ECB Economic Bulletin, Issue 7/2025.

This box summarises the findings of recent contacts between ECB staff and representatives of 71 leading non-financial companies operating in the euro area. The exchanges took place between 29 September and 9 October 2025.[1]

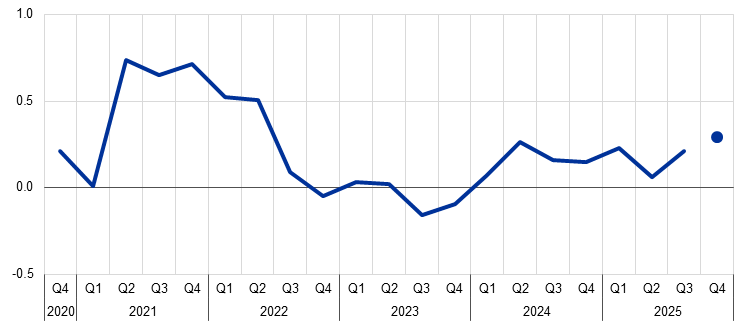

Contacts reported a slight improvement in business conditions, but these remained consistent with only modest growth in activity (Chart A and Chart B). Manufacturing output was still weighed down by tariffs, uncertainty and challenges to competitiveness as well as relatively muted growth in consumer goods spending, with little improvement anticipated in the short term. Construction activity was, however, slowly turning the corner, and many contacts in the services sector pointed to good or reasonable growth, linked especially to consumer spending on tourism and hospitality and to investment in software, data solutions and artificial intelligence (AI).

Chart A

Summary of views on activity, employment, prices and costs

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders), input costs (material, energy, transport, etc.) and selling prices, and about year-on-year wage developments. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. For the current round, previous quarter and next quarter refer to the third and fourth quarters of 2025 respectively, while for the previous round these refer to the second and third quarters of 2025. Discussions with contacts in January and in March/April regarding wage developments normally focus on the outlook for the current year compared with the previous year, while discussions in June/July and September/October focus on the outlook for the next year compared with the current year. The historical average is an average of scores compiled using summaries of past contacts extending back to 2008.

Growth in consumer spending remained lacklustre overall, given rising real incomes, although there were also some bright spots. Retailers reported modest growth as most consumers remained cautious and price-sensitive. This benefited lower-priced brands over more expensive ones and, in clothing retail, more conservative, long-term purchases over the latest fashion. Clothing retailers in particular faced increasing competition from international e-commerce. Rising rates of “cart abandonment” online were also cited as an indication of increased consumer hesitancy at the point of purchase. Demand for passenger cars remained flat amid regulatory uncertainty and a take-up of electric vehicles that remained well below a path consistent with future emission reduction targets. On a more positive note, manufacturers of household appliances and consumer electronics said activity was “a bit better” or “broadly positive”. Moreover, contacts in the tourism, hospitality and entertainment industries said that activity in their sectors had grown strongly over the summer (especially in southern Europe) and continued to see a bright outlook.

Chart B

Views on developments in and the outlook for activity

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in activity (sales, production and orders). Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dot refers to expectations for the next quarter.

Investment in machinery and equipment remained subdued, contrasting with strong growth in spending on digitalisation and AI. Widespread geopolitical and policy uncertainty, tariffs and high or increasing regulatory and labour costs were all said to be weighing on physical investment, with decisions tending to be postponed and firms making smaller, incremental investments rather than larger ones. Many contacts in the manufacturing sector expressed frustration at the burden of environmental, social and governance regulations and pointed to increased market penetration by Asian (especially Chinese) competitors that benefited from significantly lower overall costs. A higher level of activity in residential real estate markets was translating into a pick-up in construction, but at a very gradual pace. By contrast, many firms were investing strongly in digital infrastructure, giving rise to substantially growing demand for software and databases, particularly cloud solutions, and AI. This was driven by a need to increase efficiency, transform business models and remain competitive. Providers of such services also reported that these investments were particularly strong in the financial and public sectors. The increasing deployment of AI was, at the same time, starting to disrupt the business model of traditional consultancy firms.

The employment outlook remained relatively subdued. Feedback was consistent with slightly declining headcount on average, which was a less negative picture than three months ago. Employment declines were concentrated mainly within the intermediate goods and automotive sectors, reflecting the ongoing challenges they faced. Elsewhere employment was mostly stable, but with some increases in more strongly growing sectors and countries. Placement agencies continued to report a challenging environment. Temporary placement activity seemed to be stabilising at low levels and permanent hiring continued to fall as firms delayed hiring decisions and favoured temporary staffing solutions. People were reportedly also becoming more reluctant to switch jobs, as salary offers no longer met their expectations.

Chart C

Views on developments in and the outlook for prices

(averages of ECB staff scores)

Source: ECB.

Notes: The scores reflect the average of scores given by ECB staff in their assessment of what contacts said about quarter-on-quarter developments in selling prices. Scores range from -2 (significant decrease) to +2 (significant increase). A score of 0 would mean no change. The dot refers to expectations for the next quarter.

Contacts reported a further slight slowdown in selling price momentum in recent months (Chart A and Chart C). This was mainly driven by price moderation in the services sector, reflecting some cooling in price growth in labour-intensive sectors such as hospitality, intensifying competition in telecommunications, and sharply declining prices for shipping and related logistics services. Food retailers and producers mostly reported prices being raised to pass through rising costs, which in some cases reflected effects of climate change and related regulation. Growth in food prices was, however, expected to moderate in the coming months. Non-food retailers and consumer goods manufacturers, meanwhile, reported flat prices or only very modest price growth in view of still relatively weak demand and price-sensitive consumers. Elsewhere in the manufacturing sector, prices were mostly flat or declining, reflecting weak demand, overcapacity and increasing import competition (caused in part by the redirection of trade flows as a result of increased US tariffs). For this reason, most contacts in the manufacturing sector also reported stable or declining input costs for raw materials and components.

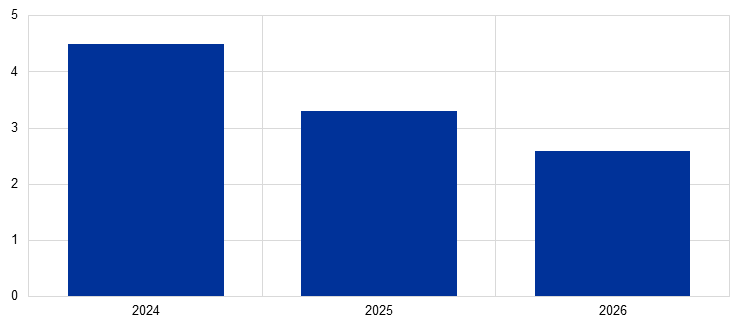

Contacts reconfirmed a picture of moderating wage growth (Chart D). On average, the quantitative indications provided would imply that wage growth is expected to slow, from 4.5% in 2024 to 3.3% in 2025 (both figures unchanged from the previous survey round) and further to 2.6% in 2026 (0.2 percentage points below the previous survey round).

Chart D

Quantitative assessment of wage growth

(percentages)

Source: ECB.

Notes: Averages of contacts’ perceptions of wage growth in their sector in 2024 and their expectations for 2025 and 2026. The averages for 2024, 2025 and 2026 are based on indications provided by 61, 66 and 61 respondents respectively.

Reaction to the EU-US trade deal was mixed, and the impact on euro area activity and producer prices was still viewed as negative. While some contacts welcomed the EU-US trade deal as a reasonable compromise, many stressed that uncertainty remained as details were still unclear, further changes could be made and deals were yet to be struck with other major economies. The impact on euro area activity was assessed as negative – not just because of reduced exports to the United States but also in view of increased import competition, as the EU market was the most exposed to the diversion of trade flows. Most contacts in upstream manufacturing industries therefore said that the effect of US tariffs on euro area producer prices was negative. So far, however, this downward pressure on prices was not widely perceived by contacts in the consumer goods or retail sectors, suggesting still little or no impact on final consumer prices in the euro area. Feedback from contacts in companies exporting goods to the United States, meanwhile, suggested that most of the cost of tariffs was being passed on to US customers, although a significant portion was also being absorbed in margins (Chart E). There was reportedly little direct spillover to euro area prices (via global pricing or to cushion the impact on margins).

Chart E

Price responses of euro area exporters to increases in US tariffs

(percentages of responding firms)

Source: ECB.

Notes: The chart reflects the interpretation by ECB staff of the responses from a sub-sample consisting of 28 firms exporting to the United States to the question: "To what extent are higher US tariffs (i) being passed through to higher prices in the United States, (ii) being absorbed in margins, (iii) resulting in higher prices also in the euro area (due to global pricing or to cushion the impact on margins)?

References

Elding, C., Morris, R. and Slavík, M. (2021), “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB.

For further information on the nature and purpose of these contacts, see Elding, Morris and Slavík (2021).