- 26 MARCH 2025 · RESEARCH BULLETIN NO. 129

Effects of monetary policy on labour income: the role of the employer

We look at the role that firms play in determining workers’ wages and employment responses to monetary policy shocks.

Our analysis shows that, when it comes to employment, young firms are especially sensitive to monetary policy shocks. We also show that wages of workers at large firms react more than those of workers at smaller firms, with notable variability – differences between large and small firms are more evident during monetary policy easing. The differential wage response is driven by workers earning above-median wages and cannot be fully explained by a worker component. Notably, larger firms adjust wages more significantly despite experiencing similar changes in investment and turnover compared to smaller firms.

How does monetary policy tightening affect employment at different firms?

In Bobasu and Repele (2025, forthcoming), we use matched employer-employee administrative data[2] from Germany. Our empirical methodology relies on the seminal contribution of Abowd et al. (1999). We estimate panel fixed effects regressions to explain labour market outcomes in terms of employment and wages. We then augment these regressions to include monetary policy shocks and the characteristics of workers and firms.[3] And we also control for various macroeconomic indicators such as real GDP, unemployment rate and inflation.[4]

We estimate the effects of a monetary policy shock on individual employment probabilities by firm type. Chart 1 presents the results of the regressions. The point estimates suggest that a surprise tightening of 25 basis points reduces the probability of remaining employed by 0.17% (blue bar in column 1). Columns in yellow show the coefficients for firm size and age of the same regression with fixed effects and controls.[5] At 0.05%, the probability of becoming unemployed if working for a young firm is significantly higher than for an older firm. However, the coefficient for firm size is insignificant (yellow bar in column 2).

Finally, we assess whether this differential effect is the result of a worker component, a firm component or a combination of the two. To assess this, we introduce a triple interaction term between monetary policy shocks, a firm and the worker characteristic of interest. Relevant coefficients are shown in the red columns. The interactions between monetary policy and both the firm and worker characteristics are significantly negative. This indicates that the age of a firm and the skills of workers matter independently for monetary policy’s impact on employment probabilities. Nevertheless, while worker skills and firm age are significant independently, the interaction between young firms and low-skilled workers does not seem to induce a significant differential impact of monetary policy on the employment probability, as shown in the last triple interaction coefficient in the red patterned bar. These results suggest that sorting alone cannot fully account for the greater sensitivity of workers’ employment probabilities in young firms to monetary policy shocks.

Our results are consistent with a well-established literature on the subject. Moser et al. (2022) find that initially, within firms, lower-paid workers are more likely to leave employment following an adverse monetary policy induced credit supply shock. Similarly, Coglianese et al. (2021) find that the increase in unemployment following monetary policy tightening is larger for workers at small, young firms.

Chart 1

Impact of monetary policy shocks on employment probabilities by firm type

Notes: Significant coefficients at the 1 and 5 levels are shown in a solid colour, while insignificant coefficients are shown in a patterned colour. Errors are clustered at the individual and firm level. Fixed effects include year, worker, firm, industry and industry with year, and the aggregate control variable is GDP growth interacted with the monetary policy shock measure. Monetary policy shocks are standardised series from Jarociński and Karadi (2020). The regressions coefficients are obtained by interacting the characteristic of interest with the monetary policy shock series, and should be interpreted in relative terms, with the baseline being “large”/ "old” firms. Small is a dummy equal to 1 if the firm employs less than 50 employees in a given year; Young is a dummy equal to 1 if the firm has existed for less than five years; Low Skill is a dummy equal to 1 if the workers’ education level is: no diploma, while the other options would be vocational training or university degree The estimation sample is for 1999-2018.

In the second stage of our analysis, we categorise firms based on size, age and whether their average wages fall above or below the overall sample average, and we explore how monetary policy affects wages across firm types. Our main finding is that wages at smaller firms are less affected by monetary policy shocks compared with those at larger firms. Our preferred specification – illustrated in Chart 2, column 1 – suggest that a surprise tightening of 25 basis points wages by 1.7%. However, the effects are not homogenous across the different firms. When additional fixed effects and controls are introduced, the model’s explanatory power improves markedly.[6] This adjustment also diminishes the magnitude of the interaction coefficient, suggesting that part of the monetary policy impact is mediated through firm-specific, worker-specific, industry and regional factors. Results in column 2 indicate that a surprise tightening of 25 basis points decreases wages at small firms by 0.63% less than at large firms, effectively amounting to more than a third of the wage decline observed among workers at larger firms. This result is robust across various industries and regions and holds up under a series of sensitivity analyses.[7] By contrast, firm age is not a relevant dimension of the differing wage responses to monetary policy shocks (see the patterned blue bar in Chart 2, column 3).

Notably, our evidence confirms that firm size independently drives the differential wage response to monetary policy shocks. Even when we incorporate a triple interaction involving monetary policy, worker skills and firm size – as seen in the yellow bars – the additional term proves statistically insignificant, and our primary coefficient remains virtually unchanged. Although worker skills do contribute to the differential wage response, their effect is roughly half the magnitude of that driven by firm size. Finally, results also indicate that low-paying firms adjust wages by almost 1% less, a coefficient slightly higher than firm size (see the red bar in Chart 2).

Monetary policy shocks appear to influence wages in an asymmetric manner. Our analysis reveals that wages in larger firms – the baseline category – react about two and a half times more during easing episodes than during tightening episodes. [8]

Chart 2

Impact of monetary policy shocks on individual wages by firm type

Source: Authors' calculations.

Notes: Significant coefficients at the 1 and 5 levels are shown in a solid colour, while insignificant coefficients are shown in a patterned colour. Errors are clustered at the individual and firm level. Fixed effects include year, worker, firm, industry and industry with year, and the aggregate control variable is GDP growth interacted with the monetary policy shock measure. Monetary policy shocks are standardised series from Jarociński and Karadi (2020). The regressions coefficients are obtained by interacting the characteristic of interest with the monetary policy shock series, and should be interpreted in relative terms, with the baseline being “large”/ "old” firms. Small is a dummy equal to 1 if the firm employs less than 50 employees in a given year; Young is a dummy equal to 1 if the firm has existed for less than five years; Low Skill is a dummy equal to 1 if the workers’ education level is: no diploma, while the other options would be vocational training or university degree; Low-paying is a dummy equal to 1 if the firm’s average wage is below the average wages paid by the other firms in the sample. The estimation sample is for 1999-2018.

How do wages of high and low-paid workers at different firms react to monetary policy shocks?

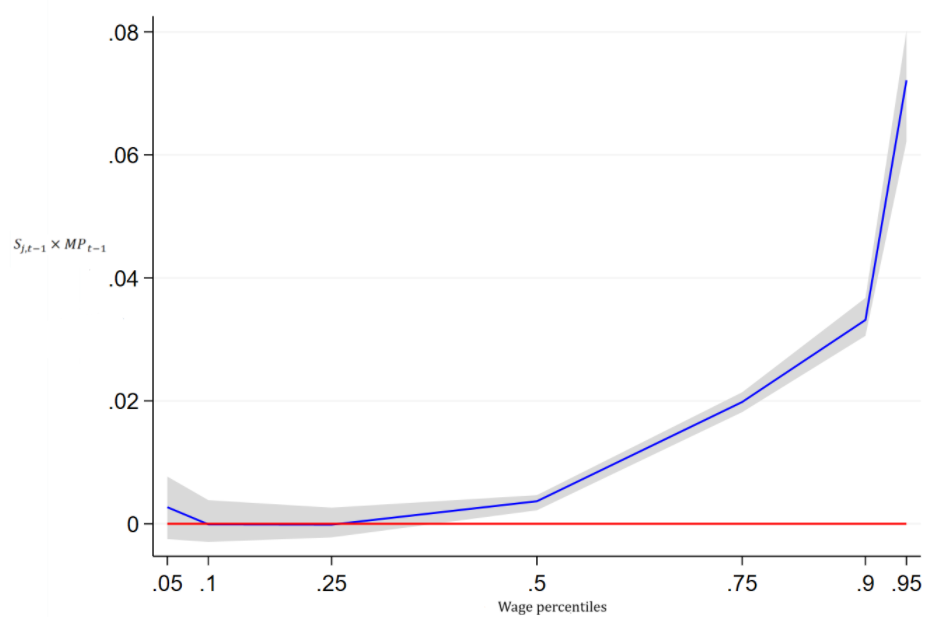

Next, we present estimated effects based on a quantile regression framework using the two-step procedure from Borgen et al. (2021).[9] These highlight potential non-linearities in the transmission of monetary policy shocks to wages. Chart 3 shows our baseline estimated elasticities for firm size, estimated on various percentiles of the wage distribution. Interestingly, the effect is only significant for median and above-median earners – there is no difference between the responses of wages in small and large firms for the lowest-paid quartile of the wage distribution. This suggests that, following a monetary policy shock, large firms adjust their wages more as suggested from the results in Chart 2, but for high-earning workers only.

Chart 3

Impact on individual wages of monetary policy shocks by firm size

(percent)

Sources: Authors’ calculations.

Notes: Confidence bands are set at 95%. Errors are clustered at the individual and firm level. Standard errors are obtained by bootstrapping with 50 repetitions. Monetary policy shocks are standardised series from Jarociński and Karadi (2020). is a dummy equal to 1 if the firm employs less than 50 employees in a given year. The estimation sample is for 1999-2018.

Differential pass-through of shocks to wages at different firms

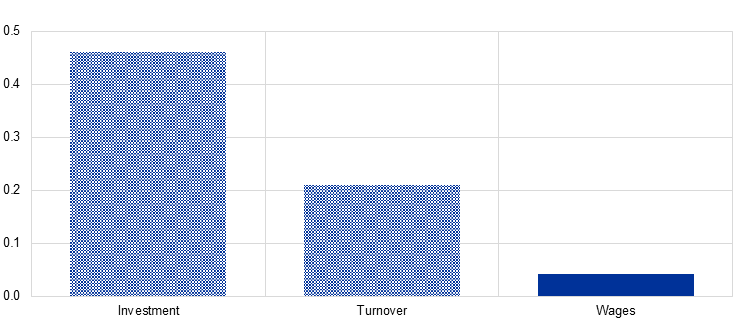

Results so far indicate that large firms adjust their wages more following monetary policy shocks, especially for their high-paid workers. So, we try to shed light on the reasons for this. In particular, we look at whether this is because larger firms are more affected by monetary policy shocks than their smaller counterparts, or because their pass-through of shocks to wages is higher.

Chart 4 presents the results for the effects of monetary policy on investment (column 1), turnover (column 2) and wages (column 3). The results indicate no significant difference between small and large firms in terms of the impact of monetary policy shocks on investment and turnover – this is made clear by columns 1 and 2. This indicates that our baseline results do not come from heterogeneous exposure of small and large firms to monetary policy shocks. Instead, column 3 shows that small and large firms adjust their wage bills differently; small firms appear to decrease wages less than larger firms.[10]

Chart 4

Heterogeneous pass-through of monetary policy shocks across small and large firms

Sources: Authors’ calculations.

Notes: Significant coefficients at the 1 and 5 levels are shown in a solid colour, while insignificant coefficients are shown in a patterned colour. Errors are clustered at the firm level. Monetary policy shocks are standardised series from Jarociński and Karadi (2020). The regressions coefficients are obtained by interacting the characteristic of interest with the monetary policy shock series, and should be interpreted in relative terms, with the baseline being “large”/ "old” firms. Small is a dummy equal to 1 if the firm employs less than 50 employees in a given year. In column 1 the dependent variable is real total investment, in column 2 it is real turnover and in column 3 it is total real wages. The estimation sample is for 1999-2018.

Conclusions

Our analysis sheds light on the role firms play in determining workers’ employment and wages responses following monetary policy shocks. We use administrative data that provide employment statistics for a representative sample of German workers and their employers. We find that monetary policy interventions affect the employment of workers at young firms more than that of those at older firms. Additionally, wage adjustments differ by firm size: workers at larger firms experience more significant changes compared with those at smaller firms. Notably, these effects are asymmetric, with wages reacting more strongly during easing episodes than tightening ones, consistent with the existence of downward wage rigidity, and the disparity between large and small firms becoming even more pronounced during periods of easing.[11] Overall, our results highlight the importance of considering both the wage and employment margins of firms’ adjustment to monetary policy shocks, as these dynamics directly influence households’ consumption and welfare behaviour.

References

Bobasu, A. and Repele, A. (2025), “Effects of monetary policy on labour income: the role of the employer”, Working Paper Series, forthcoming, ECB.

Borgen, N.T., Haupt, A. and Wiborg, Ø.N. (2021), “A new framework for estimation of unconditional quantile treatment effects: The residualized quantile regression (RQR) model”, SocArXiv 42gcb, Center for Open Science.

Coglianese, J., Olsson, M. and Patterson, C. (2023), “Monetary policy and the labour market: a quasi-experiment in Sweden”, University of Chicago, Becker Friedman Institute for Economics Working Paper No. 2023-123.

Di Maggio, M., Kermani, A., Ramcharan, R., Yao, V. and Yu, E. (2022), “The pass-through of uncertainty shocks to households”, Journal of Financial Economics, Vol. 145, No 1, pp. 85-104.

Jarociński, M. and Karadi, P. (2020), “Deconstructing monetary policy surprises—the role of information shocks”, American Economic Journal: Macroeconomics, Vol. 12, No 2, pp. 1-43.

Marotzke, P., Anderton, R., Bairrao, A., Berson, C. and Toth, P. (2016), “Wage adjustment and employment in Europe”, Globalisation and Labour Markets research paper series, University of Nottingham.

Moser, C., Saidi, F., Wirth B. and Wolter, S. (2022), “Credit Supply, Firms, and Earnings Inequality”, CEPR Discussion Papers, No 16123, CEPR.

This article was written by Alina Bobasu (Directorate General Economics, European Central Bank) and Amalia Repele (Bocconi University). The authors gratefully acknowledge the comments and suggestions received on the paper underlying this analysis from Maarten Dossche, Beatrice Pierluigi, Jiri Slacalek, Antonella Trigari and Thomas Warmedinger. The authors express their sincere gratitude for the valuable feedback provided by Alex Popov during the editing process of this research article. Additionally, they extend special thanks to Alexandra Buist, Jonathan Drake and Zoë Sprokel for their exceptional editing support. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

The data are compiled by the Institute for Employment Research (Institut für Arbeitsmarkt- und Berufsforschung) of the German Federal Employment Agency (Bundesagentur für Arbeit).

For the monetary policy shocks, we use the monetary policy surprises for the euro area from the work of Jarociński and Karadi (2020).

For more information, see Bobasu, A. and Repele, A. (2025, forthcoming).

Both firms’ characteristics, size and age, are interacted with the monetary policy shock series and therefore should not be interpreted in absolute terms, but in relative terms to the baseline.

See results when gradually saturating the regression with fixed effects and controls in Appendix Table A3 of Bobasu, A. and Repele, A. (2025, forthcoming).

As reported in the Appendix Tables A4 and A5 of Bobasu, A. and Repele, A. (2025, forthcoming).

For space reasons, we do not report the results for the asymmetric impact during easing and tightening periods in this article. See Bobasu, A. and Repele, A. (2025, forthcoming) for detailed explanations.

See N.T. Borgen, A. Haupt, and Ø.N. Wiborg (2021), “A new framework for estimation of unconditional quantile treatment effects: The residualized quantile regression (rqr) model”.

Our findings highlight the importance of a variable pay structure or bonuses, with larger firms being more likely to use them. If monetary policy tightening is associated with lower firm profits, bigger firms seem to have a greater ability to transfer this to their workers through the variable wage component. See also Di Maggio et al. (2022) who find that idiosyncratic firm uncertainty shocks are passed through to the wages of top earners through variable pay adjustments.

These findings confirm the evidence from Marotzke et al. (2016). The authors of that paper argue that, while collective pay agreements reduce downward wage adjustments, the increase in the probability of downward base wage responses following a decrease in demand is significantly smaller than the increase in the probability of upward wage responses associated with an increase in demand.