- 10 NOVEMBER 2025 · RESEARCH BULLETIN NO. 136

Monetary policy transmission through cross-selling banks

Incomplete pass-through and monetary policy transmission

When central banks raise or lower policy rates, banks typically pass these changes through only incompletely to the interest rates they pay on customer deposits. In the wake of policy rate hikes, this incomplete pass-through widens the “deposit spread” between what banks pay in interest on deposits and what they earn by re-investing deposited funds at or above the policy rate. Conversely, in the wake of policy rate cuts, the incomplete pass-through reduces the deposit spread. From the perspective of depositors, this makes bank deposits a relatively less attractive way to invest their savings following policy rate hikes and more attractive following cuts, compared with the risk-adjusted returns on investing in other financial assets, such as stocks, bonds and money market funds, which tend to move more closely with policy rates. As a result, customers tend to reduce their bank deposits following policy rate hikes and increase them following cuts. Moreover, deposits are typically the main way that banks refinance lending, given that deposits entail on average a lower cost (Drechsler et al, 2017), lower interest rate risk (Drechsler et al, 2021) and lower liquidity risk (Li et al, 2023). Lower deposit growth thus tends to reduce banks’ loan supply. Therefore, a less complete or weaker pass-through of monetary policy to deposit rates implies a stronger transmission to deposit volumes and loan volumes, and thereby to inflation. But why is the pass-through incomplete in the first place?

Existing work explains incomplete pass-through but not deposit losses

The leading explanation in the existing literature – the deposits channel of monetary policy paradigm (Drechsler et al, 2017) – posits that banks exploit their market power to maximise deposit profits in the current period only, without regard to profits a current or new depositor might or might not bring in future periods. The paradigm can fully explain incomplete pass-through. However, when policy rates are negative, banks often pay deposit rates above policy rates, as demonstrated for example by Basten and Mariathasan (2023) for Switzerland, Eggertsson et al (2024) for Scandinavia, and by many papers for the euro area, including Heider et al (2019). In fact, banks often pay deposit rates above policy rates not only when policy rates are negative, but also when they are low (see, for example, Basten and Juelsrud, 2025, for evidence from Norway). This seems hard to explain using a framework in which banks care only about deposit profits in the current period and in which it would seem more sensible to risk an outflow of deposits than to try to retain them at the cost of loss-making spreads.

Reconciling incomplete pass-through and deposit losses

In Basten and Juelsrud (2025), we propose a new framework that reconciles incomplete pass-through and deposit losses. We do so using a framework in which banks offer more attractive deposit rates to retain depositors and gain new ones to later convert them into cross-selling clients. Basten and Juelsrud (2023) showed that the acquisition of a depositor is similar to an investment: banks incur an initial loss on deposits in the hope of generating future profits by selling additional products (such as mortgages) to clients who may be reluctant to switch banks. We show that the incentives offered to attract clients, in the form of more attractive deposit rates, vary with policy rates. When policy rates fall, the net present value (NPV) of future cross-selling profits increases, prompting banks to reduce deposit rates less relative to the reduction in policy rates, in order to attract new clients. Conversely, when policy rates increase, the NPV of future cross-selling profits declines and banks raise deposit rates less relative to the increase in policy rates, because they are less concerned about losing depositors and the associated cross-selling profits.

Empirical analyses with data on every bank-household relationship

To quantify empirically the extent to which monetary policy rate changes are passed through to depositors, we regress deposit rate changes on policy rate changes. And to investigate how this pass-through varies with a client’s cross-selling potential, we also interact the policy rate changes with different measures of each client’s cross-selling potential, which, at the baseline, is measured as each depositor’s estimated propensity to take out a mortgage with the same bank in subsequent years.

However, a big empirical challenge in determining how deposit rates vary with each client’s cross-selling potential is that the rates may vary also with the loan demand the bank experiences and the bank’s resulting refinancing needs. We use Norwegian annual tax data for 2004-18 for the universe of bank-household relationships. In this set-up, cross-selling potential is shown to vary with demographic factors. For example, depositors aged below 30 are more likely to buy property and hence take out a mortgage in the coming years than older depositors who often already own property, and parents tend to buy larger properties than non-parents. Moreover, the same bank operates in municipalities where there are more young depositors and parents than in others. This allows us to compare policy rate pass-through for the same bank in the same year, and hence with the same refinancing needs, across municipalities with different demographics and therefore with different cross-selling potential.

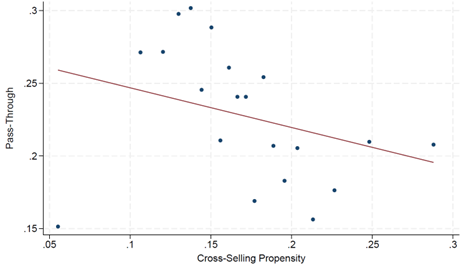

We find weaker pass-through given greater cross-selling potential

The results confirm our hypothesis that the greater the cross-selling potential is, the lower the pass-through is from policy rate changes to deposit rates, as illustrated by Figure 1. This also holds after controlling for the Herfindahl Hirschmann Index (HHI) of municipal deposit market concentration, which is the more common metric of bank deposit market power used to support the deposits channel paradigm. Conversely, even after controlling for our metric of each individual client’s cross-selling potential, the HHI retains its explanatory power, implying that cross-selling considerations and the deposits channel are not alternatives but complement each other.

Furthermore, our paradigm is confirmed also when controlling for the effects on pass-through of any of the demographics factors observable to us and the bank, such as age and family size, which seem likely to influence both cross-selling potential and clients’ sophistication in choosing the best deposit product.

Figure 1

Cross-selling and pass-through from policy rate changes to deposit rates

(fractions)

Source: Basten and Juelsrud (2025).

Notes: We first estimate cross-selling propensity for each individual bank-household relationship. Then we compute average pass-through and average cross-selling propensity at the level of each bank. Finally, this bin-scatter figure plots mean pass-through against mean cross-selling propensity with a separate dot for each group of banks with similar cross-selling propensity.

The evidence also suggests that the weaker pass-through to clients with greater cross-selling potential translates into stronger transmission to deposit growth and loan growth for such clients. Hence, cross-selling considerations matter for the entire chain of monetary policy transmission.

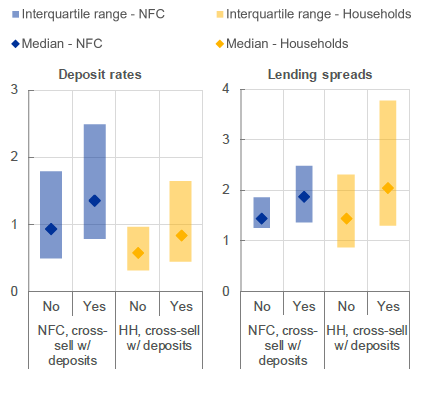

Relevance of cross-selling across the euro area

Using the Norwegian tax data for our baseline analyses allows us to compare, for every bank-household relationship in an entire banking sector, and for the same bank and year, how clients with different cross-selling potential obtain different deposit rates and make different choices in terms of their deposit volumes in response. This enables us to more cleanly identify the causal mechanisms than is possible with less granular data. At the same time, it may raise the question of whether our findings are in any way specific to Norway. To address this question, Figure 2 uses data which the euro area’s Single Supervisory Mechanism (SSM) collects as part of its Supervisory Review and Evaluation Process (SREP). The SREP survey asks banks explicitly whether cross-selling considerations matter for their product pricing. Their responses allow us to compare both deposit pricing and loan pricing across banks that take cross-selling potential into account and those that do not. We find that banks that take cross-selling into consideration pay higher deposit rates, for given policy rates, to both non-financial corporate (NFC) clients and household (HH) clients, consistent with an effort to attract clients by offering more attractive deposit conditions (Figure 2, left-hand panel). At the same time, they charge higher lending spreads to both types of client if they take cross-selling into account (Figure 2, right-hand panel). Given that these data are not currently available for a sufficient number of years, they do not allow us to quantify the significance of these patterns, nor to link them to policy rate changes. Nevertheless, they suggest that cross-selling considerations affect the pricing of bank products across the euro area, with its approximately 350 million inhabitants.

Figure 2

Cross-selling and deposit pricing in the euro area

(percentage points)

Source: Basten and Juelsrud (2025).

Notes: The left-hand panel shows deposit rates paid to clients and the right-hand panel shows lending spreads charged. In each panel, the first two dots and bars capture bank relationships with non-financial corporations (NFCs), the other two capture relationships with households (HHs). In each case, “Yes” refers to banks who in a survey administered by the SSM say that cross-selling matters for their pricing, whereas “No” refers to banks that say it does not. In all cases, the dot shows the median, while the bar shows the interquartile range.

Conclusions

Our work shows both theoretically and empirically how banks optimise not just current deposit profits but also the lifetime value of each client, and how this matters for the transmission of monetary policy. In particular, stronger cross-selling considerations weaken the pass-through from policy rate changes to deposit rates and thereby strengthen the transmission of monetary policy to deposit growth and loan growth. At the same time, our findings imply that differences in cross-selling potential across countries, banks and regions – for example based on differences in home ownership, demographics or the readiness of customers to switch banks – can lead to heterogeneous transmission of the same monetary policy. Our findings also show how the components of a bank’s franchise value, namely its deposit franchise and its loan franchise, can be intricately interlinked not only because deposits refinance lending, but also through the cross-selling of loans to existing depositors.

References

Basten, C. and Juelsrud, R. (2025), “Monetary policy transmission through cross-selling banks”, Working Paper Series, ECB, No 3072.

Basten, C. and Juelsrud, R. (2023), “Cross-Selling in Bank-Household Relationships: Mechanisms and Implications for Pricing”, The Review of Financial Studies.

Basten, C. and Mariathasan, M. (2023), “Interest rate pass-through and bank risk-taking under negative-rate policies with tiered remuneration of central bank reserves”, Journal of Financial Stability, Vol. 68.

Drechsler, I., Savov, A. and Schnabl, P. (2021), “Banking on deposits: Maturity Transformation without Interest Rate Risk”, The Journal of Finance, Vol. 76(3), pp. 1091-1143.

Drechsler, I., Savov, A. and Schnabl, P. (2017), “The Deposits Channel of Monetary Policy”, The Quarterly Journal of Economics, Vol. 132(4), pp. 1819-1876.

Eggertsson, G., Juelsrud, R., Summers, L. and Wold, E. (2024), “Negative Nominal Interest Rates and the Bank Lending Channel”, The Review of Economic Studies, Vol. 91(4), pp. 2201-2275.

Heider, F., Saidi, F. and Schepens, G. (2019), “Life below Zero: Bank Lending under Negative Policy Rates”, The Review of Financial Studies, Vol. 32(10), pp. 3728-3761.

Li, L., Loutskina, E. and Strahan, P. (2023), “Deposit market power, funding stability and long-term credit”, Journal of Monetary Economics, Vol. 138, pp. 14-30.

This article was written by Christoph Basten (Directorate General Research, European Central Bank) together with Ragnar Juelsrud (Norges Bank). The authors gratefully acknowledge the comments of Alexander Popov, Alexandra Buist, Kalin Nikolov, Simone Manganelli and Luc Laeven. The views expressed here are those of the author and do not necessarily represent the views of the European Central Bank or the Eurosystem.